Hello folks, how you have been, and welcome to 26 new subscribers who have joined us in the last month. I’m back with one more exciting blog, and this time the company is related to the hospital sector. The hospital sector has already given 54% return in the last year, double of what Nifty 50 had given in the same time period (as of October 10, 2024). Recently, Dr. Agarwal’s Health Care has filed a DRHP with SEBI seeking a fresh issue of INR 300 crore as well as an OFS of 6.95 crore with an issue size of INR 3000 crore, though the valuation and final issue size are still pending. The company that we’ll be discussing in the blog is a subsidiary of Dr. Agarwal’s Health Care. No, I’m not discussing here whether you should subscribe to the IPO or not. LOL!

What do you interfere with from this stock price chart?

Sane person: Hi Shaurya! Why are you covering this stock? It’s already 180X post listing. Upside will be limited from hereon; let’s cover some other stock.

Curious person: Okay! Stock has given 20% CAGR till date, but do let me know what are key triggers from here for this stock?

If you fall in the first category bucket, please stop reading my blog from here, as your predetermined brain will not be able to absorb the whole thesis of this blog. If you’re from the second category bucket, then bear with me. I bet you will not be disappointed.

Following is the agenda of today’s blog:

Industry Overview

I. Healthcare sector

II. Eye Care Industry

II. Hub and Spoke Model

Business Demystified

I. Short history with promoter background

II. Business Model

III. Geographies of Centres

IV. Management

Development Happening in Unlisted Space

DAEHL VS PEERS

Accelerator Pitch ~ Key Thesis

Key Risks

Financials and Valuation

1. Industry Overview

I. Healthcare Sector

The healthcare delivery market in India is expected to grow at 9-11% CAGR from ₹6.3 trillion in Financial Year 2024 and reach ₹9.1-9.3 trillion in Financial Year 2028. Even though we call India the next superpower, our healthcare statistics convey something else. India has 15 beds per 10,000 population, while for China and the USA this number stands at 29 and 43, respectively. In FY23-24, our healthcare expenditure as a percentage of GDP is a mere 1.9%, which the GOI aims to increase to 2.5% of GDP by 2025. If you’re visiting a hospital, there is a higher probability that you will incur 50% of major healthcare expenses out of your pocket. Such is the status of our healthcare sector.

The industry overview is for the new reader who doesn’t know about the healthcare industry. Skip this and jump to the eye care industry if you’re already well versed in the healthcare sector.

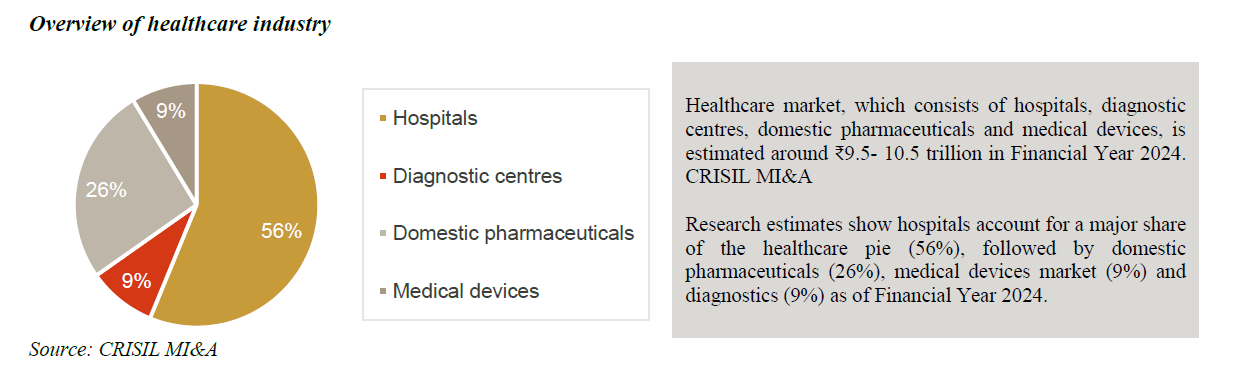

The healthcare sector is predominately divided into 4 types, with each having a different set of markets and customers. About 56% of the healthcare industry is covered by hospitals alone. Out of that, India has 69% private hospitals, and the remaining are government-owned.

Hospital includes regional as well as PAN India players too. Fortis, Apollo, Narayana Hrudayalaya, Max, etc. are some examples of hospitals. While domestic pharmacy includes Dr. Reddy, Glenmark, etc. Dr. Lal Path Labs and Metropolis are covered under the diagnostic segment.

While majorly there are two types of hospitals: single specialty and multi specialty. However, 4 types of hospital services exist, which are described below.

Single-specialty tertiary care hospitals: These hospitals treat a particular ailment (such as cardiac, cancer, etc.). Prominent facilities in India include the Escorts Heart Institute & Research Centre (New Delhi); Tata Memorial Cancer Hospital (Mumbai); HCGEL Oncology (Bengaluru); and Sankara Nethralaya (Chennai).

Multi-specialty tertiary care hospitals: These hospitals offer all medical specialties under one roof and treat complex cases such as multi-organ failure, high-risk, and trauma cases. Lilavati Hospital and Hiranandani Hospital in Mumbai and Apollo Multispecialty Hospital in Kolkata are examples of multi-specialty tertiary care hospitals.

Before deep diving into the eye care industry, which is one of the main agendas of this blog, let me take you to the key metrics to understand the hospital sector in a better way.

Sources of revenue: Hospitals have two sources of revenue: one is inpatients (IP), while the other is outpatients (OP). About 70% of patients are inpatients, so what is the difference between inpatients and outpatients? As the name suggests, IP includes such patients who stay in a hospital for more than one day, while OP includes such patients who stay for one day only. IP can be charged more than OP as they stay for > 1 day, which includes rental charges, consultancy, and a major part of the bill is surgery cost, which usually constitutes 60-65% of the bill.

Customer structure: Four types of receiving payment from customers are out of pocket, private insurer, PSU insurer, and government scheme. While cash or out-of-pocket expenses cover almost 50% due to the low penetration of insurance in India. In terms of profitability from the hospital angle, cash and insurance stand at numbers 1 and 2, while the government scheme is least favorable as it includes so much hassle in recovering dues from the government.

Let’s understand the most important topic while analyzing any business, Unit Economics, which many folks neglect. Having an understanding of revenue and cost drivers gives an edge while reading and analyzing any business, irrespective of the sector.

Let’s breakdown the key metrics in simple language. Occupancy signifies how many beds are occupied out of the available beds; occupancy also depends on the volume of patients; in the case of multi-specialty hospitals, occupancy is generally on the higher side. ALOS, or average length of stay, is generally used for inpatients as they stay for more than one day. Higher the ALOS, higher will be the occupancy, hence more revenue for hospitals. Outpatients are generally 3-4 times of IP as they usually visit for day only and hospitals can’t charge them more apart from consultancy, medicines, or day surgery (if any). Average revenue per occupied bed, or ARPOB, signifies how much revenue a hospital is able to generate from an occupied bed, which depends on the payer mix, like international patients have a higher ARPOB due to higher charges.

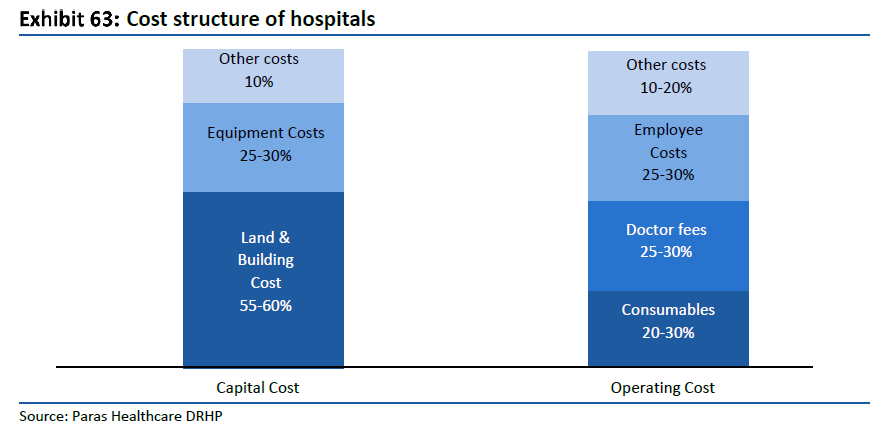

Move on to cost drivers, which are divided into two parts: capital cost and operating cost. Capital cost further consists of land and building, and equipment cost commonly refers to as a capex/bed. While operating costs include doctor fees, wages, rentals, facility management expenses, and repair costs. 20% is the blended operating margin of hospitals, as it’s difficult to reduce cost by a large extent. That’s why medical tourism is important for hospitals, as they can generate higher ARPOB, thereby higher operating margins.

II. Eye Care Industry Overview

In India, 1 out of every 5 individuals faces vision loss disorder, so out of the 140 crore population, 20% are facing vision loss disorder, or roughly 28 crore Indians. The economic value loss because of avoidable sight is estimated to be $27 billion in India. I’m assuming if you’re reading this blog, you may also be wearing spectacles. Am I right?

Even China is trailing us in vision loss disorder (Chalo! kahi to ham Indians aage hai). Don’t be happy. Eyes are a very important sense for our body; you can’t imagine your life without vision; it will be a complete blackout.

The eye care market in India has been growing at a CAGR of 11.5% between Financial Year 2019 and 2024 to reach the value of ₹378 billion in Financial Year 2024. Indicating a CAGR of 12-14%. This growth is higher than the CAGR growth rate of 9-11% projected for the healthcare delivery market in India during the same period.

In the eye care industry, qualified staff and experienced ophthalmologists are one of the key critical factors patients consider while selecting a hospital for treatment. Additionally, a patient-focused approach is a key factor in how patients choose their eye care service provider.

Segmentation of the Indian eye care market

The eye care industry is not so complex like other hospitals, where one has to keep tracking every key metric. The surgical treatment includes surgery such as cataract surgery, retina surgery, refractive surgery, glaucoma, and cornea-based surgery. About 80-85% of revenue comes from surgery treatment only, while non-surgery includes regular eye checkups and proper screening to prevent vision loss. Think like an eye doctor, where you can charge higher fees for patients regular checkups or cataract/laser surgery. The second answer is the second one. Simple as that.

The eye care industry is highly fragmented. The share of eye care service chains in India is about 13–15% of the total eye market. While the remaining share is taken by government-based hospitals, charitable/trust hospitals, and standalone clinics, which you can find in your locality, it indicates that the eye care industry is so unorganized where no PAN India player exists.

Key Eye Disorder in India

Out of the 5 commonly occurring types of eye disorders, cataract has the majority share; based on the National Blindness and Visual Survey in India (2015–2019), untreated cataract was the cause of 66.2% cases of blindness and of 71.2% cases of visually impaired cases.

Vision loss is such a huge issue for national development that GOI has introduced ‘Netra Jyoti Abhiyan’ to clear the backlog in the cataract surgeries in India. Each state and union territory has been allotted yearly targets for cataract surgeries. Cataract surgeries under the NPCB&VI increased from 6.7 million in Financial Year 2019 to 8.3 million in Financial Year 2023, against a target of 7.5 million in Financial Year 2023. This was on account of a slowdown in target accomplishment due to the COVID breakout. Out of 14 million cataract surgeries, GOI has done 8.3 million surgeries. So (excluding GOI) 5.7 million surgeries were done by private players for FY23. Even governments outsource their surgeries to private players out of that 8.3 million numbers. Going forward, the volume of cataract surgery in India is projected to grow at a CAGR of 4-6% between Financial Year 2024 and 2028 to reach the surgery volume of approximately 17-19 million in Financial Year 2028.

In India, on average, the cost for cataract eye surgery ranges from US$300 to $400 per eye, which is significantly lower than the average cost for cataract surgery in other countries.

India is dominating the global eye care market with performing 83 lakh cataract surgeries in FY 2022–23, surpassing the combined figures of the US, Europe, and China.

Other surgeries apart from cataract surgery are cornea, refractive, and glaucoma surgeries. Of the total eye surgery operated in India, the refractive surgeries contribute to about 8-10% of the surgeries; 40-50% of the Indian population is affected by refractive eye disorder, but the majority of the population solves this issue with the use of eyeglasses.

I will not go deep into each and every type of eye surgery; if you wish to read, I will share the link to DRHP below.

Growth Drivers for the Eye Care Industry in India

- Aging Population: India is experiencing a demographic shift, with more people entering the older age bracket. The share of the population in the above 60-year age bracket, which was just 7% in 2001, is expected to increase to 12% by 2026. The aging population will lead to a rise in the prevalence of eye disorders in India. Diabetes is more common in old age and is linked to a retinal disorder often known as diabetic retinopathy.

- Changing Lifestyle: A changing lifestyle, such as an increase in time spent on electronic devices, may increase the eye disorders. If you’re reading this blog, then you're as well covered in this growth driver.

- Rising Income Level: Rising income brings affordability for better medical services. For instance, in urban India, the number of people who do not want to wear eyeglasses or lenses is increasing and are opting for corrective surgeries like LASIK in order to correct refractive errors. Gen Z generation, right?

- High brand equity, network presence, and standard operating procedures (SOPs): Imagine you are facing problems in your eye. Where will you go to a professional eye hospital that has a good brand image or a nearby clinic (assuming the price difference is negligible)? There's a high probability that you’ll go with the first option; no one wants to compromise with their eye checkup. Do you?

A strong network of hospitals allows for better coordination between different branches, facilitating seamless patient care. In a competitive Indian eye market, where accessibility and convenience are crucial factors for consumers, a high network presence gives eye care service chains a competitive edge. SOP, or standard operating procedure, which means patients will receive the same quality of care regardless of location, helps the eye chain grab market share from local doctor clinics.

It is expected that more than 2,000 eye hospitals would be established across India in 5 year’s time by four to five large players.

III. Hub and Spoke Model

Hub and Spoke model applications are found in the airline industry, where hub is a central airport that flights are routed through and spokes are the routes that planes take out of the hub airport. Let’s take an example: Ganesh wants to travel from Punjab to Chennai, but there is not a lot of demand from Punjab to Chennai, hence it is not economical for any airline. So what airline do they fly Ganesh from Punjab to Delhi and then from Delhi to Chennai via connecting flight? Delhi is called the hub, and Punjab, as spoke.

A similar model is used by eye care hospitals, where they have three centers: primary, secondary, and tertiary. Following are the roles of the centers:

Primary Eye Care: Services in primary eye care include examination of the visual system, diagnosing for any abnormalities in the visual system, and prescribing aids such as glasses and contact lenses.

Secondary Eye Care: Services provided by the ophthalmologist in these centers include cataract surgeries, simple glaucoma surgeries, and other minor surgical procedures.

Tertiary Eye Care: These centers provide eye care for a complete set of eye-related diseases. Ophthalmologists with subspecialties in eye care diseases are staffed at these centers. These centers may also perform research and provide training to secondary centers.

In this model, a hub acts as a site of specialty areas, and the spokes are the connecting secondary centers. Patients first go to the primary center for an eye checkup, which is called a spoke acting as a first place to be visited by patients, and if situation permits, these patients are sent to the secondary center. These centers mostly perform cataract surgeries, and for any complicated surgery, these centers refer the patients to the tertiary centers of eye care located in the city. So you will ask me why there are 3 types of centers when the whole thing can be done in a single multiplex center?

The whole crux for going with the three centers is that the majority of patients who visit primary centers have refractive error or cataract disorder, which usually gets cured by glasses or cataract surgery if required. So why spend a big chunk of money on rents when you can handle your primary center with a small area? Unit economics will deteriorate for no reason. See the below-attached image to gauge how all three centers are different from the initial investment point of view (we will discuss more in detail in the unit economics part of this blog).

So let’s start with the deep dive analysis of Dr. Agarwal’s Eye Hospital, which is the only listed eye hospital chain, growing at a very healthy rate post-covid.

2. Business Demystified: Dr. Agarwal’s Eye Hospital

I. Short History with Promoter Background

Dr. Agarwal’s Eye Hospital was founded in 1957 by Dr. Jaiveer Agarwal and registered in 1994 as a company. DAEHL is a leading chain of eye hospitals with a predominant presence in Tamil Nadu. Under the able leadership of Dr. Amar Agarwal, the company has been a pioneer and leader in the Indian ophthalmology market with an established market position and healthy brand recall in the eye care segment.

Dr. Jaiveer Agarwal ji has introduced refractive keratoplasty with the cryolathe in India and was also the first to start cryoextraction in the 1960’s. He was honored with the prestigious Padma Bhushan by the Government of India in 2006. Dr. Jaiveer ji has started his journey with almost zero rupees; he doesn’t have a slit lamp (basically, a slip lump is used to examine the eye issue). He performed his first surgery for INR 250, out of which the patient has given him INR 200 as an advance, which Jaiveer ji has used to purchase the instrument before his first surgery.

Currently, Dr. Amar Agarwal, son of Dr. Jaiveer Agarwal ji, undertakes the operations of the group companies; he is also an ophthalmologist by profession.

“Since childhood, he has made me fascinated by this field,” Prof. Amar Agarwal said. I still remember my first glaucoma surgery was done with him sitting next to me and teaching me. I must have taken more than an hour, but he would not get upset at any step.” Narrates Dr. Amar Agarwal.

II. Business Model

DAEHL is the only listed hospital that is purely into an eye care chain. They are having a presence in the whole chain, from checkups to consultations to surgery and providing opticals to patients. According to the latest DRHP filed by its parent company, the holding company, which is Dr. Agarwal’s Health Care, has a market share of 25%, so a subsidiary will also be in the same line as the holding company. I will touch upon the structure of holding and subsidiary in the later part of the blog.

DAEHL mainly has three verticals where they derive the majority of their revenue: surgeries, opticals/lenses, and pharmaceutical products. In FY24, the company has derived > 60% of revenue from surgeries only, which is in line with what the holding company has derived from surgeries income.

The company operates under the network of the “hub-and-spoke” model, which supports high patient volumes and yields economies of scale, allowing greater accessibility and choice to patients while driving efficiency of crucial doctor resources across the network. The good part is that they don’t purchase any land or building; in fact, they take on a lease from their holding company, converting it into lease rentals, thereby saving upfront capital, and their breakeven point as well as ROCE is best in industry.

DAEHL CFO/Sales in FY24 stood at 28%, while for hospital leader it stood at 22%.

III. Geographies of Centers

The holding company has 165 facilities in India spanning 13 states and four UTs and 15 facilities across 9 countries in Africa. DAEHL only has a presence in India, not outside of India. So African facilities have nothing to do with DAEHL. While, as per the latest annual report of FY24, DAEHL is operating in 50 locations in India. However, the geographic concentration risk always exists in this company, as the majority of the hospitals are located in South India.

The holding company has increased its presence in West India, as reflected in the below-attached image.

Marketing expenses have doubled from FY20 to FY24 while they're 5 times FY21, which shows that the company is in expansion mode as visible from their geographical presence, from 22 locations in FY20 to 50 locations in FY24.

However, the company is going big in Maharashtra and nearby locations; that’s why you’ll see heavy marketing expenses in AR of FY24.

IV. Management

Management and good corporate governance should be two points on which every investor should focus; all other things are secondary. Finding a decent-growing company with well-run management is much more fruitful than finding the next big thing in the market with not so much experienced management.

I will not go deep into management and corporate governance analysis class. By going through the short history of the company and how Dr. Jaiveer Agarwal ji has started this company, and now his son, Dr. Amar Agarwal, is taking the company to new heights, there is no such requirement for CG analysis. Just attaching the DAEHL board of directors snippet from the latest AR, you can go through their educational qualifications, and YOE, it will clear all of your doubts.

3. Development Happening in Unlisted Space

Tracking down the unlisted space activity is much needed as both unlisted space and listed space go hand in hand. If any trend is visible in VC/PE space, there is a high probability that it will also emerge in listed space too. You have to keep tracking who is funding what, what’s their major thesis, and all. Similarly, I came across from Bastion Research X the recent funding happening in the unlisted healthcare sector.

During the last 2 years, globally, hospital chains have raised funding of US$ 9.8 billion, out of which India stood at number 1 and the USA at number 2 in funding by country data.

One thing that caught my eye was that Dr. Agarwal’s Health Care, the holding company of DAEHL, is number 3 in the top funding round across the world during the last 2 years.

According to private sources, TPG and Temasek hold approximately a 30% stake in the company (post-money valuation of approx. INR 4500-5000 crore), which they wanted to dilute either partially or fully in the coming IPO of the company. Will touch upon it in the key thesis section of the company.

Other notable major deals in the unlisted space are:

Manipal Enterprise Heath: In April 2023, Temasek Holdings (Private) Limited, a Singapore-based sovereign wealth fund, acquired a 41% stake in Ranjan Pai-led Manipal Enterprise Health for Rs. 16,000 crore. This took the total stake held by the sovereign wealth fund from 18% to 59% and valued the company at Rs. 40,000 crore, making it the largest healthcare deal to date.

CARE Hospital: In October 2023, private equity giant Blackstone acquired a majority stake in CARE Hospitals, which in turn had inked a definitive agreement to buy KIMS Health. The deal was worth ~$1 Bn ($700Mn for CARE and $360-420Mn).

A few days back, it was reported that General Atlantic had acquired Ujala Cygnus, a leading hospital chain in northern India. Though the financial details are not disclosed, the deal has valued the chain at Rs. 1,600 crore.

Some other notable deals that happened in the eye care hospital chain are:

In May 2024, Centre For Sight announced approximately ₹8.3 billion in investment from Chrys Capital.

Chrys Capital is founded by one of the veteran investors, Mr. Ashish Dhawan.

In 2023, Quadria Capital, which is a private equity firm, announced investment in Maxivision Hospitals. The PE firm planned to invest ₹13 billion to acquire a stake in the eye care service chain company.

In 2022, ASG Eye Hospitals raised ₹15 billion from General Atlantic and Kedaara Capital.

In 2020, private equity firm InvAsent invested ₹700 million in Sharp Sight Group of Eye Hospitals.

This demonstrates the importance of VC/PE players interest in the Indian hospital chain. All these activities reiterate the fact that Indian hospitals in general are seeing insane levels of growth due to increasing income, aging population, increasing chronic illness, medical tourism, etc. Private hospitals will be a big beneficiary of this megatrend.

4. Accelerator Pitch ~ Key Thesis

If you’re contrarian, then your thesis must be well researched so that it can counter market participants critics. Let’s move on to the backbone section of this blog.

Unit Economics: Unlike other hospitals where unit economics are highly skewed towards inpatients, the DAEHL business model is skewed towards outpatients, as mostly patients visit for an eye check, consultation, or surgery. Even surgery doesn’t usually extend beyond 2-3 hours; hence, day-visit patients are more in eye hospitals. Hospitals save on bed requirements, which is the major capex for any hospital, as well as rental costs per area and staff requirements, which are generally low in comparison to any other traditional hospital. The eye care market had the highest OPBDIT and lowest cost of sales as a percentage of the operating revenue among the specialties considered for Financial Year 2023 due to lower capital and operating costs in the industry.

Lease Liabilities: Post-IND AS 116 lease liabilities have impacted so many companies, as they have to go with both the numbers pre- and post-numbers, especially companies belonging to QSR, airlines, and retail sectors. If anyone wishes to read—> IND AS 116

Coming back to the topic, DAEHL, like I told the company, doesn’t purchase land and buildings; what they do is they take on lease, resulting in a saving of cash flows. That’s why you will see company CFO/PAT is more than 80% during the last 5 years. The impact of lease liabilities for lessees is shown in two ways: the right to use assets, which are depreciated over the lease term, and interest on lease liabilities. Secondly, give the impact of payment of lease liabilities in the cash flow statement. Even after that, the company has doubled their CFO in the last 5 years.

Why is it a win-win situation?

Expansion: DAEHL saves upfront cash flow, which they can use to expand their business; the ROCE of the company after adjusting the lease liabilities is 30%, and the operating margin of 29-30%, which is industry leading, shows that the company is not getting the valuation that it deserves. The holding company, Dr. Agarwal’s Health Care, can use their subsidiary to expand their geographies at a faster rate, which they are doing too since they operate on a “hub and spoke model.”.

DAEHL continues to identify and relocate select mature facilities, which cater to a high volume of patients, and expects footfalls to increase further to nearby locations.

The holding company follows an acquisition-led inorganic expansion strategy, which includes business transfers as well as equity-based acquisitions. It helps the company rapidly expand into new markets and allows us to tap into high-quality clinical talent by acquiring qualified doctors.

Operating in Niche Segment: DAEHL operates in an eye care chain, which itself is projected at a CAGR of 12-14% in the next 4 years. The growth in the eye care industry would be continued to be driven by a rise in income levels, awareness, an aging population, and a changing lifestyle. The recent study by CRISIL has estimated that the eye care chain has the second-best IRR in metropolises, while they have the highest IRR in non-metropolitan cities.

Why do they have the highest IRR? First think, then read it further. Hint: I have already discussed this part.

The eye care and dental care treatments, typically, do not require overnight hospitalization compared to other considered specialties. This leads to less requirement of land for these specialties and consequently lower expenditure as centers for both of these specialties usually operate on a rent/lease model.

Capital expenditure required to start a dental center is very low compared to an eye care center (₹3 million for a dental center vs. ₹80 million for an eye care center in a metro city). Additionally, revenue per center for dental specialty is very low compared to eye care specialty (₹7 million in one year for a dental center with 2 seats in a metro city vs. 80 million in one year for a tertiary eye care center in a metro city).

Holding Company IPO: One of the important thesis of DAEHL is the upcoming IPO of the holding company, which is in the same line of business. TBH, 50% of my thesis is on IPOs and their holding company valuation. As I already discussed about TPG and Temasek stakes and post-money valuation. Considering that PE firms usually invest in any company to take a minimum of 3-4X of their initial investment.

Out of the INR 3000 crore IPO, the fresh issue is of INR 300 crore, while the remaining is an offer for sale, which is INR 2700 crore, little more than 50% of the invested amount by these PE firms. So my sense is that they will cash in their first initial investment of INR 650 crore with an exit of 4X and the remaining they will sell post-IPO. Risk of PE overhang? will discuss this in the key risk part of this blog.

It’s very obvious in the capital market that if any company wanted to raise money from an IPO, they wanted a higher valuation, so to get a premium valuation in the range of INR 16,000-220,000 crores, holding company require that their subsidiary be in the best position as it's already listed. You can’t upset the existing investors of listed space, and it’s my gut feeling that the coming quarterly result of DAEHL is going to give earning surprises to many of us due to the coming IPO in January/February in FY25.

Holding company FY24 sales were INR 1,333 crore, while DAEHL FY24 sales were INR 320 crore, implying 24% of revenue from subsidiary.

5. DAEHL VS PEERS

For the sake of simplicity, I have taken the vintage players of the eye care industry for peer comparison.

Financial Comparison

DAEHL is the leader on all parameters, but wait, Shaurya! See the numbers of Eye-7 Hospital first; I know they have eye-catching numbers. But the fact that they are having presence in only New Delhi and not in any other states, as they geographically expand this number, will look otherwise. Every other player has an OPBDIT margin in the range of 25%, but PAT reveals a real picture; two of the players with 2-4% PAT margins might have long-term debt on their balance sheet. DAEHL has a CFO of INR 57 crore on the sale of INR 268 crore due to negative working capital days.

Operational Comparison

Since zone-wise bifurcation is not given. So I have taken holding company data.

Some interesting takeaways from the above data are:

Among the peers considered, Dr. Agarwal’s Healthcare (holding company) and New Delhi Centre for Sight had the highest number of National Accreditation Board for Hospitals (NABH) accredited eye care facilities at 26 as of July 2024.

New Delhi Centre for Sight and Dr. Agarwal’s Healthcare have the most diversified presence across the cities, with New Delhi Centre for Sight having 31 facilities in tier-1 cities and 33 facilities in other cities, while Dr. Agarwal’s Healthcare has 67 facilities in tier-1 cities and 98 facilities in other cities of India.

About 62% of facilities of DAEHL are located in South India, similar to what ASG also has about 58% facilities in South India, but in FY24 DAEHL has derisked it by expanding into West India, particularly Maharashtra. One question from my side is why are they not targeting Delhi NCR for any specific reason? If you know, then please tell me in the comment section.

Dr. Arun Singhvi and Dr. Shilpi Gang are the co-founders of ASG Hospital Private Limited (ASG). Both are alumni of the All India Institute of Medical Sciences (AIIMS).

DAEHL employee cost is highest in comparison to its peers as the company follows a doctor engagement model wherein a majority of our doctors work exclusively at our facilities on a full-time basis. For which company also provides consultancy fees to doctors so that they don’t leave the company and start their own clinic?

The consultancy fees that companies pay to doctors have fixed and variable components, with the variable pay being dependent on the volume of business and revenue generated at the relevant facilities. The fixed component of their overall consultancy charges for doctors has reduced over time as a function of the growth in our facility revenues. The variable component of doctors’ compensation also depends on the nature of the facility at which they are engaged (i.e., whether it is an acquired facility or a greenfield one), the location of the facility, and the experience and profile of the relevant doctor.

6. Key Risks

Merger Risk: The holding company and subsidiary company operate in the same segment of eye care, so the merger risk will always prevail post-listing. However, within 6 months of the IPO, no such risk exists.

Ophthalmologist Shortage: India not only has a shortage of beds per 10,000 population. In India, the availability of ophthalmologists and optometrists is very low compared to the national need for these professionals. As of 2024, India has about 26,000-27,000 ophthalmologist which is about 1.8 to 1.9 ophthalmologist for 100,000 persons. Compared to the available ophthalmologists, India needs about 125,000 ophthalmologists to serve eye patients in India, which is approximately 8.7 ophthalmologists for 100,000 persons, signifying a workforce shortage in the eye care health services in the country.

Competition from Private Clinics: In India, the majority of eye care chains are located in tier 1 cities, and tier 2 and 3 cities are dominated by private clinics. The risk of more and more opening of private clinics by the individual ophthalmologists targeting any specific can hinder the expansion of DAEHL. Though the company has a full-time doctor, they also get variable fees depending on the volume and locality of the facility. One more thing is that any clinic, whether it’s dental or eye care, is generally opened by a doctor when they are in the age group of 35–40 after gaining good experience in their field. So this risk can be mitigated as India is suffering from shortage of doctors.

Private Equity Overhang: This is one of the biggest risks in listed space, PE overhang. I have already committed this mistake in my journey where I failed to time my entry due to this reason only. In the case of DAEHL, the PE overhang will remain for a certain period of time if PE don’t exit fully through the IPO route, and even if their stake remains in the company post-IPO, we have to see to whom they are selling to take the exit route. What happens in such a case that PE wants to exit, so they milk the growth of the company, and generally they exit when growth gets peak and at peak valuation too. It’s not necessary that they will be able to time their exit. They are not God; take the example of Zomato. Many PE and VC were sold, but Zomato was 2 times their selling price. But one has to track this risk very closely.

Hold on, Shaurya! Are you saying it’s like a PP Waterballs type situation? No, man, DAEHL has genuine business; how dare you mix it with PP Waterballs? LOL(:

7. Financials and Valuations

I have already discussed the financials of the company so many times and also covered it in the peer comparison too.

DAEHL has achieved the highest ever sales figure in FY24. The sales have increased from INR 140 crores in FY 21 to INR 320 crores in FY 24, at a CAGR of 23%. While profit as of FY 24 stood at INR 62 crore, more than 10x from FY21 profit. In FY21, the company faced some dip in operating margin, but after that, OPM stood above 25%.

The cash flow from operations has further improved from INR 39 crores in FY20 to INR 90 crores in FY24. Mainly on account of long payable days, which are 300+ days from the last 4 years. Promoter shareholding is above 70%; the majority is held by the holding company, while free float is less than 25%.

In the last 12 quarters, DAEHL operating margin was below 25% only once.

Now coming to the part of valuation, I have taken two approaches for valuation. One is relative valuation, while the second is comparing it with holding company coming IPO.

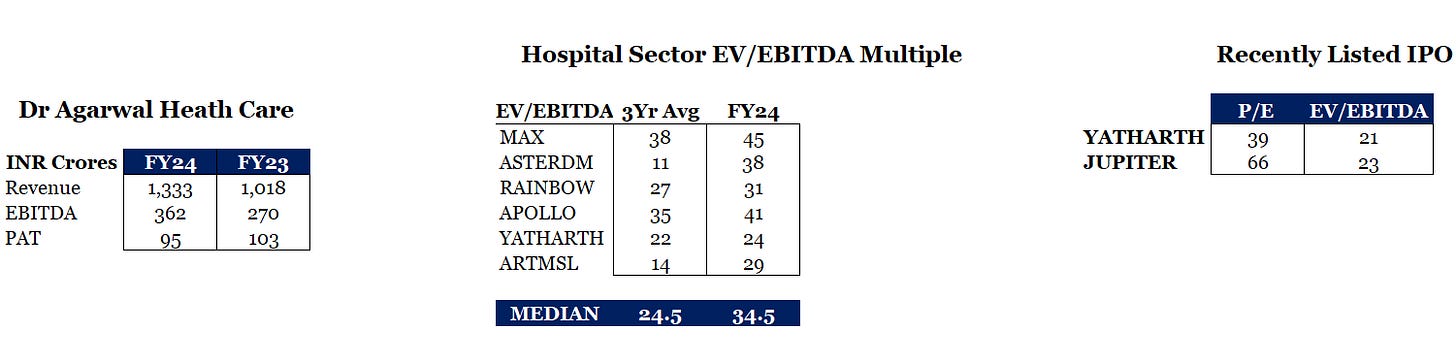

Taking a FY24 EV/EBITDA multiple of listed peers, if we go by the simple calculation, then a rough estimate of the IPO valuation of the holding company would be in the range of INR 15000-18000 crore, considering the issue size of INR 2500-3000 crore, and PE funds generally go with a higher valuation, especially during market frenzy. The market too is filled with liquidity, and the healthcare sector is performing well during the last 6 months; we can expect this valuation.

The holding company is last valued at INR 4500-5000 crore.

The Dr. Agarwal’s Health Care derives approximately 30% of revenue from DAHEL. If we assign holding company valuation to a subsidiary, as DAEHL is not so discovered stock, even no brokerage house provides any rating to it. It would be valued in the range of INR 3600-4000 crores after assigning a 20% discount. While the current valuation is INR 2600 crore. (October 11, 2024)

Secondly, if we apply the relative valuation, then DAEHL is trading at FY25 EV/EBITDA of 17-18x. (Considering lease liabilities) How?

In Q1 FY25, the company has generated sales of INR 100 crore, which is equal to 30% of full-year FY24 sales. The CWIP is going to get completed this year, and by FY25, the net block would be INR 400 crore, and considering that the company can easily do asset turns of 1.2 times, sales would be INR 480-500 crore and EBITDA would be INR 130-140 crore.

Thank you, readers, for staying with me till the end of this blog. Please provide your valuable comment, and if you like it, do like and subscribe to my substack for such exciting blogs in the future.

DRHP: Dr Agarwal Health Care

Social Media handle

Great article Shaurya! So well written and researched!

Good research