Quick Service Restaurants: Happy Meals are not Happy Anymore?

Hello folks, how have you been? Welcome back to my new blog. I know I was absent from Substack for more than 1.5 years (pardon me for my absence). Now onwards, I will try my best to write one blog once a month. Moreover, in the future I will keep a mix of both long as well as short and crisp blogs.

The topic which I’m going to touch upon is the review of Quick Commerce Restaurants (QSR) Q1 FY25 result, along with the latest developments happening. Many of the readers who are in markets pre- or even post-covid knew that 1 year ago everyone was so bullish on the QSR theme, calling it a decadal theme or a once in a lifetime opportunity. But now, no one talks about it. Why? simple answer in Howard Marks language: I think it’s fair to say one of the key swings of the investment pendulum is between too much confidence and too little. That’s what happened with the QSR theme; everyone was so bullish one year back that no major earning surprise, that too at a time when valuations are way ahead before number speaks, has resulted in the de-rating of some stocks from this sector. Don’t forget a few players from this sector have provided the lesser return in comparison to benchmarks in the last year or so.

Decadal theme always demands decadal mistakes, everyone gets into FOMO and just starts chasing the stock, without any due diligence from their part. This phenomenon is now happening in defense and railway sector.

Following are the Agenda of today’s blog;

Current Landscape of QSR Sector

What Management is Saying?

What’s Happening in Unlisted Space?

Risks and Opportunities

Conclusion

1. Current Landscape of QSR Sector

This chart is for the new reader who doesn’t know about the food services market. Skip this and jump to the next paragraph if you’re already well versed in the QSR sector. Typically, the food services market is categorised into 4 broader types, in which our focus will be on QSR only. In the Indian listed market, following are the QSR players.

Now let’s start with Q1FY25 results comparison of all the listed QSR players.

Financial Performance

In Quarter 1 of Financial Year 25, median revenue growth was 8%, while gross margin has remained more or less in line (70%). Wait! Don’t get carried away by the half information; the majority of the YoY revenue growth was contributed by Jubilant FoodWorks (Dominos India Franchise) and Devyani International (Pizza Hut and KFC India Franchise). On the financial performance basis, the worst result reported by QSR in Q1 FY25 was by Barbeque Nation (will talk in detail). The rising competition in the QSR is already hurting the listed entities, which is visible in Q1FY25 result.

Operational Performance

Jubilant Foodworks (Domino’s India PAN India Franchise) has reported the best operational figure after straight 8 quarters, driven by delivery LFL growth of 12.1%, for which the major contributor was no delivery charges above INR 150 orders. RBA too had reported a fair set of numbers; the Indonesian business is finally bearing fruit for them, while they are focusing on creating efficiency in existing Indonesian stores. The Indian business has also shown an SSSG of 3.1%. On the other hand, Barbeque Nation has not shown any sign of recovery yet. In the last year, management kept blaming a higher number of vegetarian days as having impacted their sales. Actually, their problem is more with table turns; even I don’t see BBQ has so much pricing power left with them. Many regional players are giving tough competition to BBQ.

If there is any one business where Festive Season come as a curse for them, it’s none other than Barbeque Nation (BBQ).

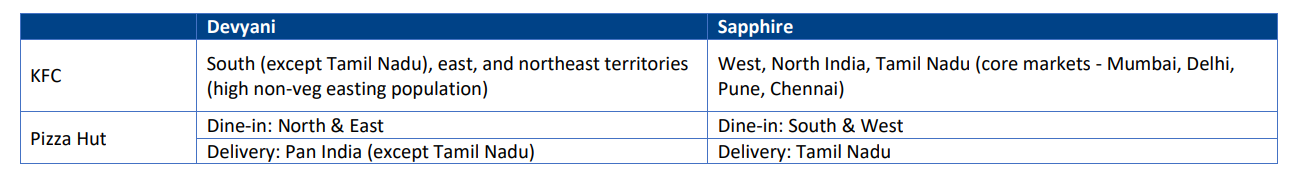

Coming to Devyani and Sapphire, both operate under the same brand, but the only difference is geographic distribution.

Even tough Devyani has a higher share of the non-vegetarian eating population, but Sapphire commands a higher ADS than Devyani in KFC segments. While both companies results were in line, management commentary has not hinted at any exciting development. KFC has shown some positive development, but Pizza Hut is facing tough competition.

2. What Management is Saying?

One thing that is common in every concall is that demand is subdued to macroeconomic headwinds and consumer sentiment is too weak. The local players are giving tough competition to international players. Huh! I’m listening to this from the last 2-3 quarters. We should try to separate wheat from chaff. So let’s move on to 3-4 key takeaways from all the calls.

Jubilant Foodworks

The company acquired new customers at its highest-ever rate, beating the industry trend. Moreover, Jubilant has not taken any price increase in the last 8 quarters.

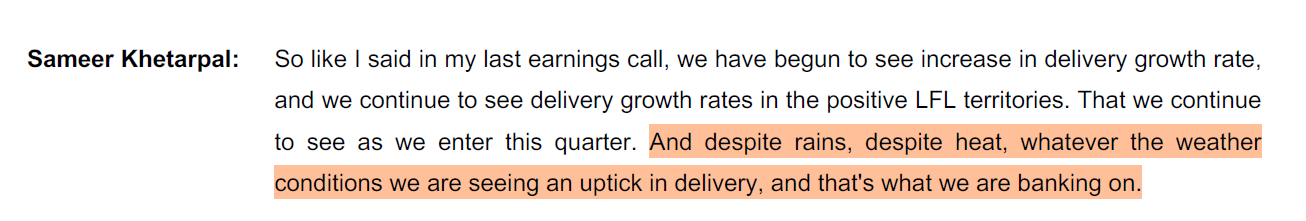

Delivery as a mix is growing. So there is also a consumer trend that Jubilant is also riding on. Delivery channel now contributes 69% in Q1 FY25. The waiving off delivery charges by the company is a cheery on the top type situation for JFL. Which has resulted in volume growth of 16% in India.

In Popeyes, the management is focusing on the chicken eating markets; that’s why more stores are in South India. Also in Popeyes, delivery share is lower and dine-in is higher at the moment.

Westlife Foodworld

Management is taking new initiatives like Chicken Surprise, a new entry-level burger, bolstering the chicken platform. Introduced new menu items like the McFiesta range and mango-flavored desserts. The value platform was launched at the end of June or beginning of July, while the entry-level chicken burger was launched in June. The benefit will be seen in the coming quarters.

Westlife has a robust value platform strategy and a pipeline of innovative products. Management is optimistic of higher average unit volume in the second half of the year. This is on account of a price increase of 3-5% in the coming quarters.

Off-premise business grew by 6% YoY, led by delivery and drive-throughs. Off-premise contribution was 42% to total sales. WFL is aiming for a 15–18% contribution from McCafe by 2027, after a successful pilot project.

Devyani International

Management is increasing marketing spend on Pizza Hut due to the continuous decline in brand from the last 12-18 months. In Q1 FY25, store opening pace was relatively slow as management objective is to bring back the brand.

Thailand business is demonstrating good growth with new store openings. After the Thailand acquisition, KFC is in a good position as brand positioning in Thailand is more mass premium as compared to India. Thailand showed positive SSSG in Q1FY25.

FY25 store guidance stood at 150, out of which 100 will be contributed by KFC while remaining from Costa Coffee. Costa Coffee's aggressive expansion is on the back of improvements in scale of operation.

Restaurant Brand Asia:

RBA management is focusing on traffic and then driving SSSG through that route. India business shown straight 9th quarter same store sales growth, main contributors are dine in marketing program and increasing share of chicken.

Management is focusing on not losing money in Indonesia by focusing on existing stores first. Popeyes Indonesia ADS stood at INR 97,000 for 10 stores. Just waiting for some headwinds to come, then they will start putting money behind brands.

BK Cafe stores number stood at 370, while ADS is between INR 14,000 and 15,000 for BK Cafe. Management is looking to double this number in the future.

Barbeque Nation Hospitality

Month-on-month improvement in SSSG for the first four months of FY25, but still, SSSG for Q1 FY25 stood at -7.4%. Management is blaming Navratri for weak demand in Q1 FY25, but I know they will again blame vegetarian days in Q2 due to Sawan falling in July and August.

According to management commentary, delivery is replacing the home cooking business and creating new demand. Hmm, Interesting!

On the mature stores, BBQ did revenue per store of around INR 5.9 crores. With a restaurant operating margin of around 15%. In new stores, BBQ did revenue per store of INR 4.6 crores with a restaurant operating margin of 8%.

3. What’s happening in Unlisted Space?

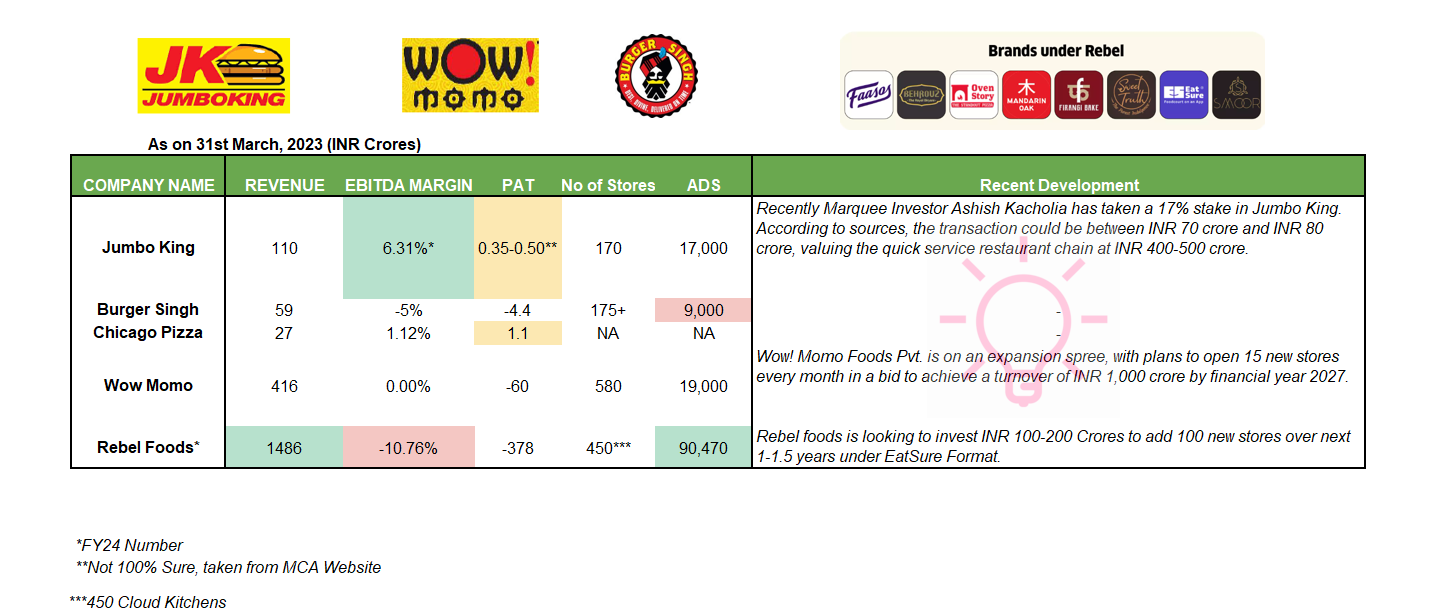

One cannot neglect unlisted space activity, especially at a time when the decadal theme is undergoing significant change every year. QSR in India is deeply funded by VCs, PEs, and seed investors. The major PAN India competitors that are emerging in this space are Jumbo King, Burger Singh, Biggies Burger, WoW Momo, La Pino’z, Chicago Pizza, and last but not least, Rebel Foods.

The unlisted QSR players are also giving tough competition to the listed QSR players on operational parameters too. The average daily sales of Jumbo King are far less in comparison to RBA and Westlife, but what matters is their unique format of stores. Jumbo King store size is 150-200 sq ft, as mainly they focus on high footfall areas and generally target one city at a time. After Delhi and Mumbai expansion, JK is focusing on South India. Similar is the case of Burger Singh; after expanding in the North East, they are targeting tier 2 and tier 3 airports.

Burger Singh on Recent Expansion; As Tier 2 and Tier 3 markets grow with expanding infrastructure, new airports are emerging in these cities. However, this growth has highlighted a significant market gap; customers at these airports often lack access to renowned branded foods. Burger Singh is addressing this gap by moving into these airports, ensuring that travelers in Tier 2 and Tier 3 cities have access to branded food. This expansion is facilitated by Burger Singh’s existing outlets and a well-established supply chain in these cities, enabling a seamless entry into the airport market.

Who would have thought McDonald's or even Domino’s would offer a meal for INR 99? To be honest, I have never imagined this in my dream.

Rebel Foods, a house of food brands, is also one of the successful cloud kitchens in India. Their brands are Oven Story Pizza, Mandarin Oak, Firangi Bake, Sweet Truth, and Faasos rolls. Recently, they also got a master franchise for Wendy’s India. Now they are targeting the dine-in segment through EatSure, little contrary to what I heard in recent conferences, where every management is increasing their focus on the delivery segment. Rebel Food is going offline. “Maybe they know better than me.”

It’s quite difficult to scale your outlets just on one brand; multibrands offer flexibility not just for expansion but to try new offerings according to changing customer preferences; even in the recent Elevation Capital QSR Podcast they have said the same thing. (Watch from 29:37.)

An entrepreneur in the cloud kitchen space said what’s become clear for platforms is the need for having multiple brands for different customer groups. “That would be based on price and the food segment. One brand won’t address all”.

4. My views on results: Risks and Opportunities in QSR Space

After so much data crunching and listening to market veterans. Let’s move on to our second-last part of this blog. Risks and Opportunities in the QSR Sector.

Focusing on Delivery Segment: The boom of food aggregator apps like Zomato and Swiggy has provided ease of access to a large population, and that too at lower prices than famous QSR chains. Delivery provides a wider audience, and food outlets are not required to penetrate every state of India. The main lever for jubilant growth in the latest quarter is none other than a rise in the delivery segment (20-minute delivery has finally borne fruit for them).

Focusing on Value Offerings: QSR can attract audiences in two ways; the first is offering value for money deals by value for money. I also consider taste, quality, interior, and less waiting time, not just by offering meals for INR 99 or 169 for premium ones.

Refurbished stores have potential to fetch more sales, trend which is visible in QSR chain.

Second is by providing some unique offerings that rivals are not providing. For example, JFL is offering Popeyes while RBA is offering BK Cafe, which is doing average daily sales of INR 14000–15000; operating leverage will kick in once stores get matured. But just focusing on price cuts will make these QSR vulnerable to more competition in the future. Jumbo King is focusing on the veggie offering, while Chicago Pizza is focusing on the mid- and premium segments.

Rise of E-commerce: Rise of E-commerce is not less than a curse for Dinein service. If I go to Zomato, there is a high probability that I will order my snacks from Non QSR. Many cloud kitchens are providing "value for money" offerings nowadays.

Zomato’s active restaurant base of 276k is much higher than the 5.5k stores of listed QSR brands as of Q1FY25. “Restaurants active with Zomato have increased to 51x total branded QSR stores in FY24 vs 22x in FY19.

I could agree on the fact Dine-in is impacted in Q1, due to the heat wave and election this time. But people’s need for convenience, which Zomato and Swiggy are providing them, even if one goes outside, there is a high probability that Gen Z always looks out for experience first. That’s what BBQ has also mentioned in his call.

Specifically for dine-in segment, which is where the product is not just food but also experience, also ambiance, service, all of these put together and you have a great meal with your dear ones, that is a segment that is continuing to remain.

One more thing that I want to clubbed with this point is that these foreign brands are not innovating enough, just focusing on brand pull strategy, which is not going to work in India. Let's see what the future holds for them.

Higher Rental Cost: QSR industry became the silent casualty of booming real estate as prices zoomed at a CAGR of 11% since Covid vs. 4.5% in 7 years prior. Causing high rental costs for F&B players in malls and prime urban locations. Thus impacting profitability and hindering expansion plans. That’s why you will see in the latest commentary that companies are cautious on their expansion plans; some are repositioning their brands, while others are focusing on existing stores first.

But going ahead, as price growth for real estate is expected to lower down to 6% in FY25, we might see margins of some of these F&B/QSR companies start recovering.

5. Conclusion

QSR is here to stay; India is such a big and fragmented market that one cannot implement US or Chinese market strategy here. One needs a different approach altogether. The rise of food aggregators brings a curse for QSR solely focusing on the dine-in segment. Companies need to differentiate themselves, whether it’s in terms of value offerings, experience, or creating internal efficiency. "Store managers are the people who run the show." It’s pretty clear that the brand pull strategy will not work in India, as Indians are price conscious. Also, solely focusing on delivery will not work, as Rebel Foods is coming offline after a year of experience in the online segment.

The rise of PE and VC activity in QSR space is also the testimony that QSR space has so much yet to explore. The only concern is which company will be the next big thing in India’s QSR space. If I have to select 2 QSR chains that are showing good future prospects, one will be Jubilant Foodworks, and the second is Restaurant Brand Asia.

Thank you, folks, for reading the whole blog.

Disclosure: Nothing in this blog should be construed as investment advice. Please consult your financial advisor.