SJS ENTERPRISES-only listed aesthetic components manufacturer

Hi this is my first post today we are discussing company which had been ignored by the market due to 800 Crore 100% OFS. Yeah you got it right It’s SJS enterprises only listed aesthetic manufacturer in India and presenting across the value chain of aesthetic components. SJS supplied 115mn + parts with more than 6,000 SKUs to ~170 customer locations in ~90 cities across 20 countries.

I will break whole analysis of mine in 10 parts-

1.Industry overview

-Introduction of aesthetic industry

-Products

-Raw material used

-End customers demand outlook

-Value chain analysis

-Tailwinds

2.SJS Enterprise-Business overview

-History

-Business overview

-Customers list

-Peer comparison

3.Acquistion of Exotech

- Why SJS acquire Exotech?

- Does acquisition really paid off?

- What to expect in future from acquisition perspective?

4.present management

5.Financials

6.Accelertor pitch

7.Risk

8.Things to watch in future

9. Final conclusion

10. Valuation

Aesthetic Components

INTRODUCTION:

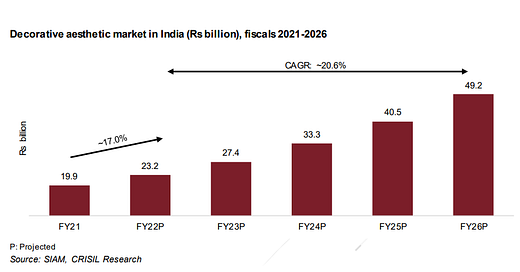

The aesthetics component industry in India generated Rs 19.9 billion in revenue in fiscal 2021 and the industry is projected to grow at a ~20% CAGR to reach approximately Rs 49.2 billion by fiscal 2026. While product features and price are key elements, product aesthetics are critical in creating brand value for original equipment manufacturers (OEMs). Consumers give preference to products that are not only value-for-money but also aesthetically superior. Aesthetically superior products hold strong relevance for discretionary consumption products, such as automobiles and consumer durables.

PRODUCTS:

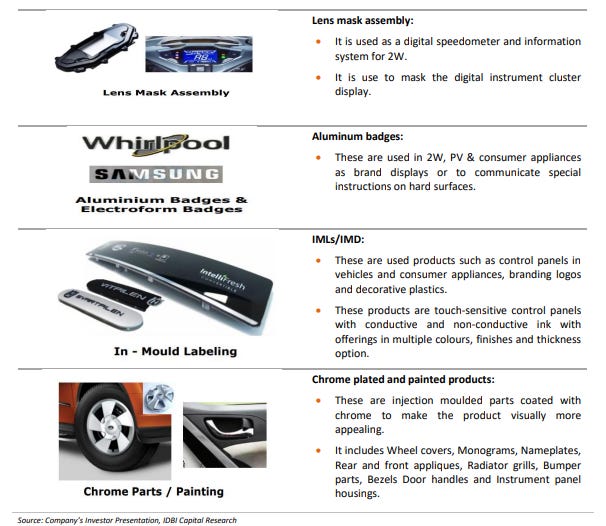

Products that are covered in aesthetic components are logos, decals. stickers, badges, optical plastics, chrome plated parts, IMD/IML Parts, 2D/3D dials.

Among the above products that most critical products are Logos, IMD/IML parts and Chrome plated parts IMD/IML are made by the process of thermoforming and injection molding you can refer the video to understand it’s process.

I will discuss only IMD/IML parts and chrome plated parts. So basically IMD/IML parts are made of Polycarbonate and polyesters. In the IML process, a plastic film is printed with decorative pattern, formed, cut to size and then inserted in the injection molding tool. During the injection molding process, the film becomes an integral part of the injection molding plastic, giving it a decorative look. While, in the IMD process, the printed pattern on the roller gets transferred on the injection moulded plastic. Unlike in IML, in IMD, the film does not become an integral part of moulded plastic. IMD is generally preferred where large volumes of flat decorated parts are to be made. While chrome plated parts are injection moulded parts coated with chrome to make the product visually more appealing. The usage of chrome parts has been increasing rapidly, especially in passenger vehicles, as OEMs are trying to distinguish models and variant by creating visual appeal with such parts.

RAW MATERIAL:

There are many common raw materials which are used to make aesthetic components these are plastic, PET, copper, nickel, aluminium, paints, metallized polyester, PVC, PC, inks, chemicals, adhesives polyester, polycarbonate or tempered glass. The PVC. polycarbonate films and polyester are common which is use in almost every aesthetic components ranging from overlays, Dials, Logos, Sticks and IMD/IML parts.

END CUSTOMER DEMAND OUTLOOK:

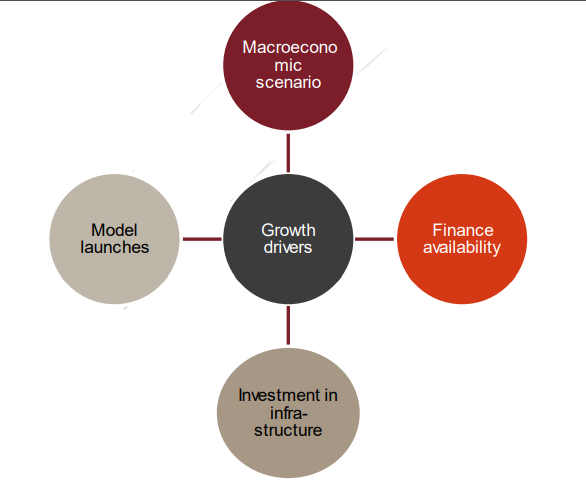

India’s 2W and Auto OEM’s demand had remained weak since after covid-19 emerges. The domestic two-wheeler production, remained flat between fiscals 2016 and 2021, with a large part of the subdued performance because of lower output in fiscal 2020, owing to transition to Bharat Stage (BS)-VI norms, and challenges heaped by the Covid-19 pandemic in fiscal 2021. However, during fiscals 2016 to 2019, the industry posted a growth of 9% CAGR, propelled by good monsoons, favourable economic situation, and rising exports. Production of passenger vehicles (PVs) in India recorded a healthy growth of 5.2% CAGR between fiscals 2016 and 2019 due to a spurt in domestic and exports demand. The key thing to watch out for Aesthetic components manufacturer is how the auto cycle plays out because indirectly their product demand depends on auto OEM’S and 2W Sales not only domestically but also foreign Auto market demand.

VALUE CHAIN ANALYSIS:

Analyses of auto ancillary includes following parameters such as:

Business risk

% of export revenue

Location

client concentration

working capital management

cost structure

product complexity

Pricing power to OEM’s and 2W

Technology

On the basis of above parameter we will analyse SJS enterprises. Now we will start with analyses of SJS enterprises. But before it we will see some tailwinds which will favor this industry over mid to long term so keep reading..

TAILWINDS:

1. Growth in the underlying application segments:

Growth in OEM’s, 2-W and even washing machine refrigerator will helps in growing this industry and as Automobile sector moves towards EV it’s presence will increase in every products as EV use more aesthetic components than ICE vehicle.

2. Shift towards premium products/variants:

Consumers are emotionally attached with discretionary products, such as passenger vehicles, two-wheelers, where such products often symbolise their lifestyle. Therefore, consumers are increasingly willing to pay for aesthetically superior and differentiated products. Consumer preference is shifting towards bigger cars. Demand for small cars have declined from ~63% in 2015 to ~53% in 2021. In addition, the demand for mid- and top- variants of passenger vehicle models has seen a gradual increase over years. CRISIL Research further expects the contribution of mid plus top variant to increase 5-10% in the small car segment, followed by 15% in the large car and UV (Utility vehicles) segment by 2026.

3. Increasing penetration of superior aesthetic products across product categories:

The penetration of optical plastics, chrome-plated parts, IML/IMD parts is currently limited to specific variants across select models across passenger vehicles. But it’s presence will increase with time In the near future, OEMs are likely to make touch screens as a standard offering across majority models in mid and top variants with improvement in technology, internet connectivity and increasing customer preference for such features. With increasing penetration of touch based navigation systems, demand for optical plastics will get a proportionate demand fillip Most of the popular models are offering 7-10 inch infotainment screens in India across different models. On the other hand Globally, OEMs are keen on deploying 15-inch screens.

The intensity of chrome plated accessories has gone up from mere inclusion of chrome plated inner door handles to front grill, trunk lid liner, head light/ tail light cover, outer door handles etc. Over the years. The trend of increasing chrome plated part intensity in a OEM manufactured vehicle is likely to continue. As a result demand for chrome plated parts from OEMs is likely to grow rapidly in future.

4. Technology shift towards higher costing newer aesthetic products:

-Shift from 2D to 3D appliques/ dials-An aesthetic component manufacturer typically makes 2-3x realization per unit of 3D dial compared to a unit of 2D dial.

-Shift from analogue to analogue - digital appliques/ dials-- Popular two wheeler models such as Hero Passion Pro, Bajaj Pulsar 125, Hero Glamour offer analogue- digital dials which cost around 6-8x times of pure analogue dial.

-Shift from analogue to touch based navigation system in cars-An aesthetic component manufacturer makes around Rs 350- 500 per optical screen in a passenger vehicle depending upon size of the screen. OEMs are launching model facelifts with larger screen sizes compared to older version.

-Shift from chrome plated logos to 3D lux logos- An aesthetic component manufacturer makes 12- 15% more realization in case of a 3D-lux logo compared to chrome plated logo. For Shine motorcycle Honda Motorcycles has shifted from chrome plated logo to a 3D lux logo over the years.

- Shift from plain moulded components to IML/ IMD components- IML/ IMD dashboards cost around 1.5-1.6x times of non- IML/ IMD dashboard per vehicle depending on vehicle category

i. Dashboard trims in Ertiga and Ciaz in higher variants have been converted to IML designs from moldings in last 3-4 years.

ii. New generation Whirlpool double door refrigerators have started featuring IML decorated parts for superior aesthetic appeal. Such components were not existent in past models

SJS ENTERPRISES-Emerging Superstar in a Niche Industry

HISTORY:

SJS enterprises was started by K.A. Joseph Managing Director and ‘J’ in SJS. He along with his partner Srinivasan and Sivakumar started this in 1987, almost 35 years back. The two S in SJS stand for Srinivasan and Sivakumar If I’m not wrong. SJS evolved and started manufacturing what are known as operator control panels for dot matrix printers for companies like TVS and Wipro Innovation and creativity have been SJS prime focus and in 1995 - 1996 they started manufacturing automotive dials. The first Hyundai Santro model manufactured in India rolled out with SJS Dials. In 2015 Srini and Siva decided to retire and this is when Everstone invested in SJS with 51% or about Rs 350 crore ($54 million). With Everstone coming on board it took SJS to a new orbit because that’s the time when Sanjay thapar man behind minda industries success comes in SJS having more than 30 year of experience in auto industry.

For more detailed history of SJS please refer below image

BUSINESS OVERVIEW:

SJS is the manufacturer of aesthetic products present in all products whether it’s traditional, Value added or premium products having more than 6000SKU’S and 160+ customers exporting to 20 countries. SJS made decals, logos, IMD/IML parts, overlays, optical plastics and chrome plated parts for which they acquire Exotech for 64crore which we will cover latter in this blog.

PRODUCTS

Till 2018 SJS produced only logos, decals, 2D and 3D dials but after 2018 they had entered into premium products like IMD/IML, Optical plastics and chrome plated parts they had completed a significant portion of its capital expenditure project and shifted to its new manufacturing facility in September 2018. In 2021 they had acquired Exotech for manufacturing approximately 50 to 60 injection molding tools per year to meet the customization requirements of the customers. SJS typically enter into a customer relationship for a specific product line, seeking to demonstrate the quality and cost efficiency of our product and services. Thereafter, in order to increase share of their business with customers, SJS pursue cross-selling opportunities and seek to expand to other product lines and geographic areas with the customer and its related entities. MG commentary on the same..

From product cycle perspective 3D badges are typically delivered to customers within three days from the date of the sales order. While IMD/IML parts take approximately 1-2 months for delivery as it includes discussion with customer then designing it as per client preference and then showing the sample to client which is long gestation period but realization is more as compared to other parts that they supply.

The design-to-delivery lead time for Company’s products, depending on the nature and complexity of the product and the manufacturing process, typically ranges from approximately 15 days to six months. SJS revenue breakup from product segment.

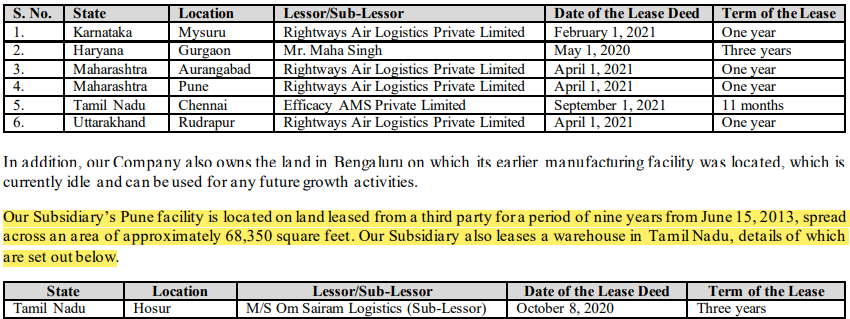

Plant facility, warehouse, Raw material , employees and logistics:

SJS have six warehouses. These are located in Gurugram in Haryana, Rudrapur in Uttarakhand, Aurangabad and Pune in Maharashtra, Kanchipuram in Tamil Nadu and Mysuru in Karnataka in India. Company also has a warehouse adjoining their manufacturing facility in Bengaluru, located within the same premises. SJS Subsidiary leases a warehouse in Hosur in Tamil Nadu to cater to the requirements of one of its largest customers, TVS Motors. SJS manufacturing facilities and warehouses in India are located close to the automotive and engineering clusters where several of their customers are based. SJS warehouses work as our delivery points to key customers enabling us to meet their just-in-time delivery schedules, drives economies of scale and logistical efficiencies for their customers insulating them from supply disruptions and enhance our engagement with them. SJS warehousing arrangements are flexible in nature and therefore storage space can be increased or decreased depending on their requirements.

Company’s supply chain and logistics team of 14 personnel handles supplies of our products to their customers. For customers located outside India, SJS generally export their products through sea shipments. Costs associated with the transportation of their products are generally included in the purchase price. In a few cases, their customers(Domestic) may directly pick up the goods at their manufacturing facilities or warehouses.

As at June 30, 2021, Company had 509 full-time employees with an average tenure of 8.2 years. Company’s average attrition rate in the last three Fiscals was 13.29% with respect to its total workforce. Subsidiary had 105 permanent employees.

For more details on their warehouse facility refer below mentioned image

In the three month period ended June 30, 2021, approximately 37.70% of the raw materials that Company sources are imported from vendors outside India whereas the remaining 62.30% of raw materials and components are procured from Indian vendors. Further, in Fiscal 2021, approximately 33.74% of the raw materials that Company sources are imported from vendors outside India whereas the remaining 66.26% of raw materials and components are procured from Indian vendors. Our Subsidiary purchases raw materials from India. Company has long-term relationships of 10 years or more with several of key suppliers. They generally do not sign any agreement with one-time vendors whereas place purchase orders with regular suppliers and may enter into arrangements with certain identified vendors. SJS do not enter into any long-term volume commitment for procuring materials.

As per my understanding company purchases mainly their products from below mentioned suppliers.

Plant visit by IDBI capital and note on the same.

Customer relationship:

Relationship with 10 largest customers (FY21 Revenue) averaged ~15 years. Pursue cross-selling opportunities and seek to expand new product lines and geographic areas with the customer. Some of the name of customers are mentioned below.

Revenue from different clients are as follows:

SJS supplied to everyone with the sole exception of Hero as indicated by MG in Q3 CC

Now let’s see beyond the MG guidance on customer relationship and try to solve the puzzle(Try not to fall in storytelling) as we already know that domestic OEM’S and 2W such as TVS, HMSI, Bajaj auto, M&M and Suzuki all are preparing to launch their new products in FY22 and more aggressively in FY23 when black clouds gets top off from Auto industry and we live in India in we can easily see which new products are coming in market but what about Global OEM’s we barely track them so let’s see the position of Global OEM’s in present world and their new products launch which will accelerates the growth of SJS

Visteon, whirlpool and Marelli is three big customer of SJS So let’s talk about Visteon. Company in there Q1 Earning concall had mentioned that Visteon launched 16 new products in the first quarter and is setting the foundation for another year of robust launch activity. Key first quarter launches include a 12-inch digital cluster for the F-150 Lightning EV that recently launched with Ford and several center information display programs across multiple vehicle lines with Mazda, including their all-new CX-60 plug-in hybrid SUV. Additional key launches include a 10-inch digital cluster on the new Nissan Z and a 10-inch digital cluster on Honda’s first generation all-electric BEV crossover for the China market. So here in this case we can clearly see that their is increasing use aesthetic products in new launch by OEM’s. SJS will may supply Digital cluster or optical plastics to Visteon which further Visteon by applying their Technology helps their clients to fit digital cluster in cars.

Highlight of Visteon deal in Q1:

Secondly let’s talk about Whirlpool which is clearly seeing growth in India Major appliances as MG also highlighted in their Q1 concall

Just pasting image of three pillars of whirlpool so to get clarity if SJS client market is growing or not because ultimately if client doesn’t grow then how can SJS grow.

If one wants to know the complete information of SJS client like how many year of relationship, which plant supply which parts and end user segment so they can refer below mentioned image it will provide complete details some customer details had not disclosed but you can get cross check from images mentioned above.

PEER COMPARISON:

SJS has no listed player but it have competition from unlisted one. SJS competition snapshot is highlighted in below image.

Polyplastics Industries, Classic Stripes and S.J.S. Enterprises are the top three players in terms of revenue. S.J.S. Enterprises is one of the leading decorative aesthetics supplier with widest product coverage across decorative aesthetics pertaining to major vehicle segments; namely, two-wheelers, passenger vehicles and consumer durables.

1. Polyplastics Industries India pvt ltd:

Till 2020 they have huge debt of 249 crore which they managed to reduce 67 crore till 2021 march. Their major customer is MSIL. The Group has technological collaborations with overseas players like Sakae Riken Koygo (Japan) resulting in the availability of the latest technology, providing an edge over competitors. he average working capital utilisation was 43% during the 15- month period that ended in February 2021. Poly generally present in traditional segments wheel trims and wheel covers, door handles, etc. Although they produce chrome-plated plastic parts including emblems, automotive plastic-molded components. Low PAT margins, Moderate EBITDA margins, ROCE, High working capital intensive plus catering to PV only doesn’t provide cushion during bad auto cycle.

2. Classic strips:

CSPL is a leading manufacturer of automotive decals in the domestic market, with a focus on the 2W space – CSPL plans to increase its presence in the printed electronics segment, which caters to the automotive and white goods sectors, over the medium term. But the negative points are The company also faces obsolescence risk for certain decal products with the emergence of electric vehicles (which may not require few of the decal components) and digital consoles CSPL has extended sizeable financial support to the Group companies, with the overall funding of ~Rs. 205.6 crore as on March 31, 2021

3. Kongovi :

The company is involved in the production of chrome-plated automotive plastic components both for interior and exterior applications for the original equipment manufacturers of the passenger car industry. KPL supplies trims for interior and exterior applications, which are used for their aesthetic appeal. The components include grills, logos, garnishes, door handle covers, gear knobs, body moldings, mirror scalps and fog cover. The average working capital utilization stood at ~72% of the sanctioned limit during October 2020 to January 2022. Company is looking towards increasing their export share which will help them to increase their margins.

Kongovi has order book position of Rs. 123.8 crore for FY2023 positively. Negative point is that – KPL’s working capital intensity increased to 75.3% as on March 31, 2021, from 48.1% as on March 31, 2020, on account of an increase in its receivables during Q4 FY2021 which may still continue because company is looking to increase export share.

In conclusion I can say that there is no such direct mirror to mirror competition for SJS but they have only kongovi as a competitor as they are increasing export share but although it’s in traditional products.

In terms of financial position, Working capital (may increase due to export share target of 25% by 2025), global clients, High ROCE and healthy margins SJS is way ahead from it’s peers. It would be great if they onboard Hero also.

3.EXOTECH ACQUISTION

Why SJS acquires exotech?

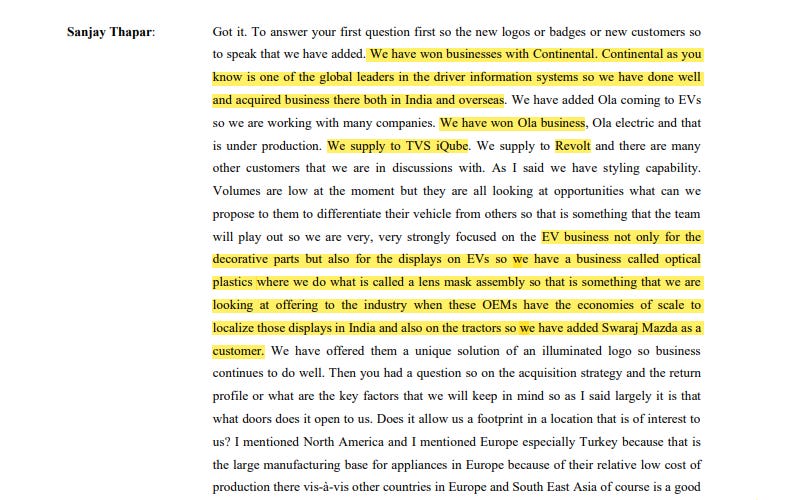

Simple answer given by MG in concall.

Acquisition of Exotech was come at a time when there is growing need of chrome plated parts across OEM’s, 2W and home appliances. Exotech don’t have any strong client base but SJS do so by combining entity they are able to perform well in future.

Does acquisition really paid off?

In my opinion yes just see the concall highlight

Revenue of 71 crore by acquiring a company for 64 crore payback period is less than one year if we compare on sales basis not on cash because SJS acquired Exotech on cash deal. The purchase consideration of exotech was 64 crore including 23 crore of goodwill so they really had not paid too much for acquiring exotech which is fair deal.

But wait! It’s not their first acquisition they had acquired Delta Ram Enterprises, Sirisha Enterprises and SM Enterprises ('Selling parties') effective 1 May 2018 ('Acquisition date'). The Selling parties were earlier acting as sole selling agents of the Company and were providing end-to-end customer relationship and marketing services to the Company. The acquisition was made to gain the synergies of the business and the customers developed by the Selling parties and hence the management concluded this transaction to be a business combination as per Ind AS 103. Pursuant to this Agreement, the Company has acquired the business of the Selling parties for a total cash consideration of ₹100 million to be paid over a period of 2 years in 24 equal installment effective 01 October 2018.

And believe me it’s a good deal wait I will show you how

Just see the sales promotion expenses from almost 7 crore in 2019 in year which they acquired these three companies it’s gone down to 80 lakh in year 2021 Fair deal!

- What to expect in future from acquisition perspective?

In terms of region which they are focusing for acquisition is Europe( particularly turkey), southeast Asia and North America.

4.Current Management:

SJS MG is consisting of KPI in industry K.A Joseph is having More than 34 years of experience in aesthetics printing business. Leads the manufacturing operations for the Company and has spearheaded technological and product innovation over the years Also, a director on the board of Exotech. Sanjay Thapar is having 30 years of experience in the auto industry. Previously Group Chief Strategy Officer with Ashok Minda Group; MD of Minda valeo Security Systems. Landscape of SJS board is given below. Please go through it SJS is really experience MG.

Now coming to remuneration part in FY21 Sanjay Thapar and K.A Joseph had taken combined salary of 48.24million which is approximately 10% of FY21 PAT.

The main reason for which street had ignored SJS is because of 100%OFS but it’s not true that company which is doing 100% OFS is trapping retail or MF. In 2015 evergraph had taken an entry in SJS by taking 77.86% of shareholding at 350 crore. In IPO Evergraph had diluted their 40% holding ar 710 crore which means they have already made 5-6X in less than 6 years and K.A jospeh the MD of company had diluted his holdings from 20.74% to 15.28% he had received 90 crore for his dilution of 5% holding almost 50x Oh my gosh!! by the way good deal. It’s not like that IPO is overpriced it’s fairly priced PE of 33 for company doing ROCE>20% and generating FCF with margins>25% . where in past loss making Fintech getting listed on invisible PE! (Zomato, Paytm) no objection just saying.

Moreover 20% Holding of SJS will remain in lock in period till 10 November,2024.

And do you know the combined promoter holding is not 50.37% it’s 51.51% go to public shareholding and you will see Sanders consulting pvt ltd sanjay thapar is director of the company and he holds 1.14% from that company. For well being of employees SJS had granted ESOP (13.89.000shares) to 206 employees out of 509 at rs 263.86 almost 40% of employees gets covered in it that’s a good sign.

I know this blog is taking too much time but I had tried to cover every part so that it will help you and me also to later visit it and see my study on the same. So please read it till the end.

5. FINANCIALS:

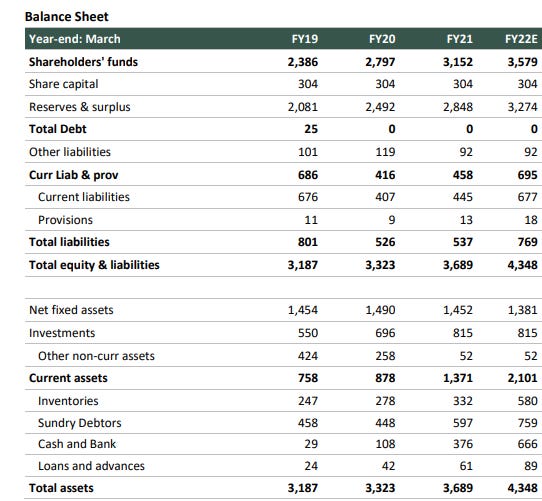

So in terms of sales SJS had sale of 184 crore in year 2017 which is increased to 252 crore in year 2021 with healthy margins in line of 30%. SJS is High growth-Low capex -High ROCE – Cash Generating business model. It is net debt free entity with Rs 1bn cash on balance sheet.

- SJS sales had increased from 237 crore in FY2019 to 320crore(Including exotech revenue) in FY21 CAGR of 10.53%.

- On the other hand Margins increased from 27% in FY19 to 29% in FY21.

- FCFF/EBITDA and FCFF/PAT both had improved drastically which is a plus point.

- Healthy ROCE and improving cash conversion cycle.

- % of raw material of sales remain inline of 35-40% which will may go down due to exotech acquisition.

- High reserve plus no long term borrowing makes SJS balance sheet more stronger which will helps them in auto cycle downturn.

- Inventories and receivables day were increased quite a little mainly because of Auto cycle downturn but from now onwards if demand backs then it will be not a great problem.

6. Accelerator pitch

Let’s discuss the Accelerator pitch for this company

- Bet on premiumization, the changing shift of consumer towards mid and large cars will drive the demand for premium product indirectly benefiting SJS as realization in these products are much higher then traditional products like Logos, decals, 2D Dials etc.

- Target of 25% exports by 2025 which will drives the margins for SJS as we have seen in kongovi case where they have increased their margins which results in margin expansion from 16% in 2020 to 24% in H1FY22 similar thing can play out in SJS.

- Acquisition and turnaround of exotech will drive margin expansion and addition of new client in various regions.

- Revival of auto cycle I’m sure that by H1FY22 or FY23 we will see a sharp revival in auto OEM’S and 2W sale which will give a huge boost to SJS sale both in domestic market and export market as globally many leading auto players are preparing for their new model launch containing many aesthetic components than previous models.

7. RISKS:

Now comes a most important part of analysis as warren buffet says risk comes from now knowing what you’re doing. I will discuss 8 key risk which I see in company

- Delay in revival of auto cycle due to semiconductor issue and Russia-Ukraine conflict can further disturb the supply chain which will directly impact SJS sales.

- Unfavourable acquisition outside India will directly impact the financial position of SJS and in auto ancillary a good financial position is very important to survive a contraction of economy or auto cycle which usually happens after 4-5 years.

- Unloading of more shares in future by private equity and K.A joseph will create a bad image for SJS in market.

- Not able to pass raw material cost to customers due to bad pricing power will have impact on margins in long run.

- Concentration risk of clients although they have reduced it by onboarding more clients outside India

- Higher dependence on customers in automotive and consumer appliance industries and decline in their performance in India or globally could impact SJS’s business.

- Stiff competition from international player especially serigraph Inc. Serigraph expertise includes printing, advanced decorating technologies and graphic solutions for the Automotive, Appliance, Consumer, Medical, Power Sports and Point-of-Purchase markets with decorating plastics being the core business.

- SJS is exposed to risks relating to fluctuations in foreign currency exchange rates.

8. Key things to watch out for:

- Improvement in capacity utilization as at March 31, 2021, the annual production capacity of SJS and it’s Subsidiary’s manufacturing facility was 208.61 million and 29.50 million products, respectively and their capacity utilization rates were of 44.07% and 52.88%, respectively, in Fiscal 2021, and their revenue from operations during Fiscal 2021 were ₹2,516.16 million and ₹685.26 million,

- Share of export in percentage of total revenue

- Addition of more clients and introduction of more value added and premium products.

- Increase in number of employees particularly NPD and operation team. As of 31 June 2021 they have 509 employees more number of employees will present a demand coming from client side because these types of companies don’t hire usually like IT companies.

9. Analyses of auto ancillary includes following parameters such as:

- Business risk- Can say High because they are dependent on OEM’s and 2W demand which is directly related to economic situation of a country.

- % of export revenue- Moderate Till now only 16% but will increase in future as per MG.

- Location- SJS plant are present in nearby of their client manufacturing plant which is good it will save logistics cost.

- Client concentration- Moderate not so high but yeah they derive majority of revenue from 2W so it will be key to watch out the demand of 2W or client loss from 2W category.

- Working capital management- SJS have cash conversion cycle of 28-30 days( as per tijori finance) but it will increase due to increase in export share.

- Cost structure- Relatively in control till now SJS can easily pass cost to their clients due to complex products increasing applications.

. SJS have VAVE program in which they constantly try to reduce cost of raw materials.

- Product complexity- For traditional products it’s low but for value added and premium product it’s high entry barrier because OEM’S and 2W don’t wants to compromise on their interior and exterior design parts so that’s why they give their order only to existing supplier which has long period of relationship. SJS average client relationship is 15 years and till today they did not lose any clients.

- Pricing power- SJS is entering into premium products like IMD/IML, optical plastics, 3D Dials and capacitive overlays in which realization. ( Upto 1.8-2.0X) is much more than traditional products.

- Technology- SJS constantly upgrades their technology in order to remain ahead in market from their competitor. SJS is looking for deal which will provides them access to new technology.

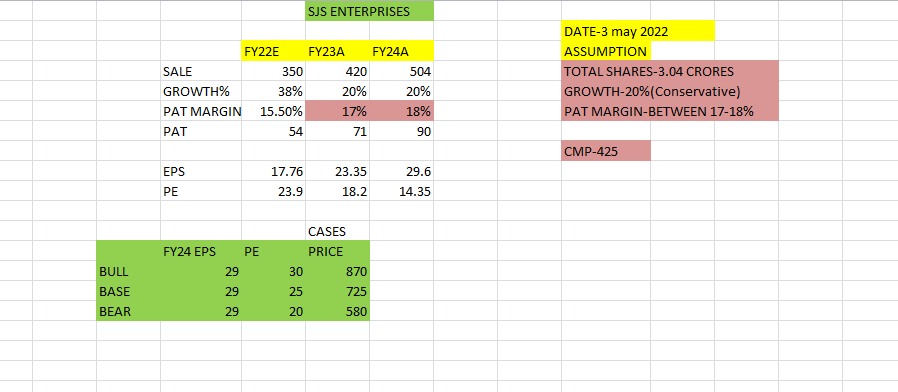

10. Valuation:

We value a SJS considering the following facts in mind:

Growth Plan: SJS’s plan for sustained growth include a) Increase in geographical footprint through exports b) Focus on development of new technologies and advanced aesthetic products c) Expand its business through strategic inorganic growth opportunities and d) Increasing its share of business with existing customers.

Sales to Double in Next 3-4 years: Based on its product profile, user industry outlook and new client additions Management is reasonably confident of doubling its sales over the next 3-4 years.

Operating Margins to be ~25-28%: Despite changing product mix the Company is confident on maintaining its operating margins in the band of 25-28% over the next 2-3 years.

Minimal Capex Requirement: SJS’s both the production facilities (Bangalore and Pune) are currently operating at ~50% utilization. Therefore, without incurring any meaningful capex, the Company has potential to double its sales from existing setup. However, given the very high demand in its Chrome plate business, SJS might likely be constrained by existing capacity and hence create some additional capacity over the next 12-18 months.

Key assumption are:

-Revenue growth rate of 20% till FY24

- PAT margin of 16%

- Share outstanding-3.04 crores

I have taken PE of 30 in bull case might be high but PE at IPO was 33 so that’s why I have taken. Similarly PE of 25 for base and 20 for bear case scenario.

If you find it useful then please hit the like button and leave a comment on what do you think about SJS enterprises.

HAPPY INVESTING JOURNEY.