The expectation infrastructure

First of all thanks to all 40 subscribers for subscribing my newsletter though I am not regular writer due to my time constraint but I will try my best to be regular and provide great insight

In this post I am not discussing any company instead I am discussing the value triggers and value factors which every investor should keep in mind before analysing any company. Thanks to Arjun badola for recommanding me Expectations investing book. After reading this book one will able to understand all the moving parts of valuation. I will try to break all the parts with case studies of indian companies.

Subscribe to this newsletter

INTRODUCTION:

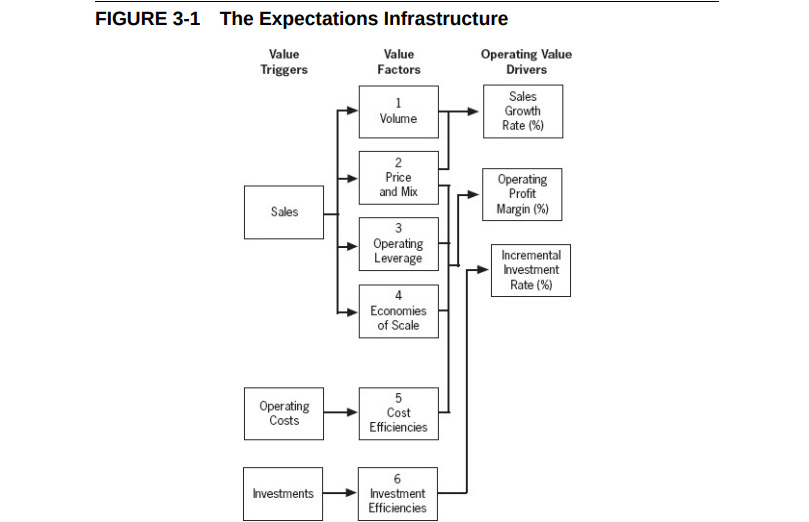

The expectation infrastructure has three main pillar first is sales which includes volume, price and mix, operating leverage and economies of scale. Second is operating cost which includes cost efficiencies and third and last is Investment which includes investment efficiencies.

1. SALES

- Volume:

Volume which in layman language means quantity more the quantity of goods. It will increase sale of any company and if company has power to increase volume with no or partial increase in cost it will be win-win situation for any company.

I hope many of you have heard of APL Apollo and Astral Poly Technik the volume growth of both these two comapnies with maintaining their margins is one of the main reason for their success. Moreover APL Apollo purchased their main raw material steel from tata stell which provides disocunt on their bulk order. Similarily Astral diversified product and pan india presence helps them to control their cost and maintain their margins.

Now let’s see a topline growth of both the companies in last 10 years

From FY11 to FY22 APL Apollo had increased their sales at a CAGR of 27%. While EBITDA has increased 10 fold from 90 crores to 945 crore.

Same volume growth is resulted in the case of Astral where sale increased at CAGR of 24%. While margins expanded from 55 crore in FY11 to 750 crore in FY22.

- Price and mix:

A change in selling price means that a company sells the same unit at a different price, whereas sales mix reflects a change in the distribution of high- and low-margin products.

Introduction of value added products not only helps in more topline growth but also helps in margin expansion.

The transition from steel cylinder towards composite cylinder is helping Time technoplast in margin expansion as well as more realisation in revenue.

As highlighted by crisil report published on 25 january 2022 which clearly indicates the margin expansion due to value added products. (Credit rating report is one of the main tool which helps investor to get insights of companies which are not available in public domain)

In Q4FY22 CC MG has highlighted the same about the increase in business of value added products by 27% in FY2022. Morover the peak margin will be in the range of 18% of value added products ( currently margin are in the range of 13-14%) and revenue realization from VAP will be 2.5X more as guided by MG.

Similarily the trend of price and mix is happening in Fiem industries and SJS enterprises, If you have not read my analysis on SJS enterprises you can read by clicking on link below.

-Operating leverage:

Operating leverage measures the degree to which can increase operating income by increasing revenue. Basically company which are having more fixed cost and less variable cost can easily take benfit of operating leverage and have high gross margin.

Let’s undertand in simple terms Businesses invariably spend significant amounts of money before their products and services generate sales. We call these outlays preproduction costs. Preproduction outlays dampen operating profit margins. Subsequent sales growth, on the other hand, leads to higher operating profit margins.

You can understand this by refering to below image.

Increase in sale with fixed preproduction cost has helped to increase Operating margin by 3,65%.

Many of you have heard of TATA ELXSI an ER&D company. From FY2018 to FY2022 Company has increased their margin from 25% to 31%. The main reason behind this is increase in contract win by TATA ELXSI and as we know the main fixed cost of any IT company is Employee cost which altogether had remained fixed and increase in revenue with no or partial increase in fixed cost has lead to margin expansion. One more reason for increase in TATA ELXSI margins are location of their IT center which are located in semi urban areas.

Margins of TATA ELXSI had increased in linear way from Q3FY20 to Q4FY22.

But for ER&D companies the employees cost can be double sided sword because when sale increase it will increase margins but when sales down and if there is less contarct win by company it will affect margins altogether as happened in Q1FY20 and Q2FY20 when margins are contracted from 26% to 18%. Same indicated by MG in 2019 CC.

- Economies of scale:

Economies of scale stand out for lower cost per unit as volume increases. These economies give larger companies a cost advantage over smaller competitors; if large enough, they can deter new competitors from entering the marketplace.

Walmart has taken a advantage of it and grab the large market of US retail sector from very beginning. Similar startegy is adopted by Avenue supermarket. Both Avenue supermarket and Walmart adopt EDLP and EDLC policies which stand for Everyday Low Price and Everyday Low Cost. Hence, they change their prices on a daily basis depending upon what their vendor is charging. The key thing in this policy is that they procure the goods in bulk and they have an advantage with major discounts and further there are no middlemen which operate for them and they have their own independent procure department which keeps on looking into the cheapest price for a particular product. Purchasing at a lower average cost which is achieved through buying in bulk is one of the sources of economies of scale which can be termed as ‘purchasing’.

In fact walmart had adopted system in early 2022 where shop keep updating their price of goods on real time basis.

You can watch the rivalry between Amazon vs Walmart by clicking the link below.

You can understand the economies of scale from below mentioned example.

As can be seen from the above table that cost has declined from 29 to 26 per ahead which signals the company is experiencing economies of scale.

2. OPERATING COST:

-Cost efficiencies:

Companies achieve cost efficiencies in two fundamental ways. Either they reduce costs within activities, or they significantly reconfigure their activities.

Companies either achieve cost efficiencies by controlling their fixed or variable cost.

Take an example of Balkrishna industries where company has control their cost by the help of low cost labour advantage and sourcing of rubber within the india which is main raw material cost in case of tyre manufacturing.

It’s clearly visible that BKT main cost advantage is labour cost where international player labour cost is 25-26% BKT has merley labour cost of 7%.

Similar trend is visible in raw material cost where raw material cost is reduced over the time which leads to margin expansions.

3. Investments:

-Investment efficiencies:

It means reduction in working capital which will helps company to invest less for same level of sales and operating profit.

Improvement in working capital days is one of the sign of investment efficiencies and question arises how woring capital days can be improved there are various reasons for it like low receivable days, high inventory turonover ratio etc.

As you can see in the example of Sreeleathers the debtor or receivable days has improved from FY12 to FY20 which leads to ROCE expansion from 4% to 13%. The main reason for reduction in debtor days is company sells its goods directly to the retail customers through showrooms and collects full payment upfront at the time of sale.

Improvement in receivable days also helped in high inventory turnover ratios. The reaason for it that instead of creating shoe manufacturing capacities in-house, the company is relying on outsourcing/other suppliers to produce shoes for it, which it then sells in its showrooms spread across India.

From this we come to an end of my second blog expectation infrastructure.

But be remember only these framwork is not a whole criteria for investment decison there are many other things we should look before investing any business.

SOURCE: Expectation investing

HAPPY INVESTING JOURNEY