Welcome to the 52 new members who have joined us since last blog. Yeh Dil Maange more was a continuation of Pepsi's advertising campaign in the mid-to-late nineties, which it had initially launched as an ambush marketing effort against Coco-Cola during the 1996 World Cup. Moreover Yeh Dil Maange more was used by Vikram Batra in Kargil War as a victory code. Pepsi had to face so many difficulties in entering Indian market at last in 1989 PepsiCo sowed its India entry through an agrarian route, despite opposition from several powerful people.

In today’s blog we’re discussing Varun Beverages one of the oldest bottler of PepsiCo India and second-largest franchisee (outside United States) of PepsiCo.

This blog might be long and detailed so, keep your Pepsi ready ( Yes no tea and coffee this time).

I will break my whole analysis in

1. Industry

- Introduction

- Raw material

- Oligopoly/ Imperfect competition

- Tailwinds

2. Varun Beverages-Business overview

-History

-Business overview

- Products and Geographies

- Distribution

- Agreement with Pepsico India

- Peer comparison

- Sustainable development steps

3. Entering into Other segments

4. Capex and Debt reduction

5. Financials

6. Accelerator pitch

7. Valuation

8. Key Risks

Capitalizing the under-penetrated Indian beverage market

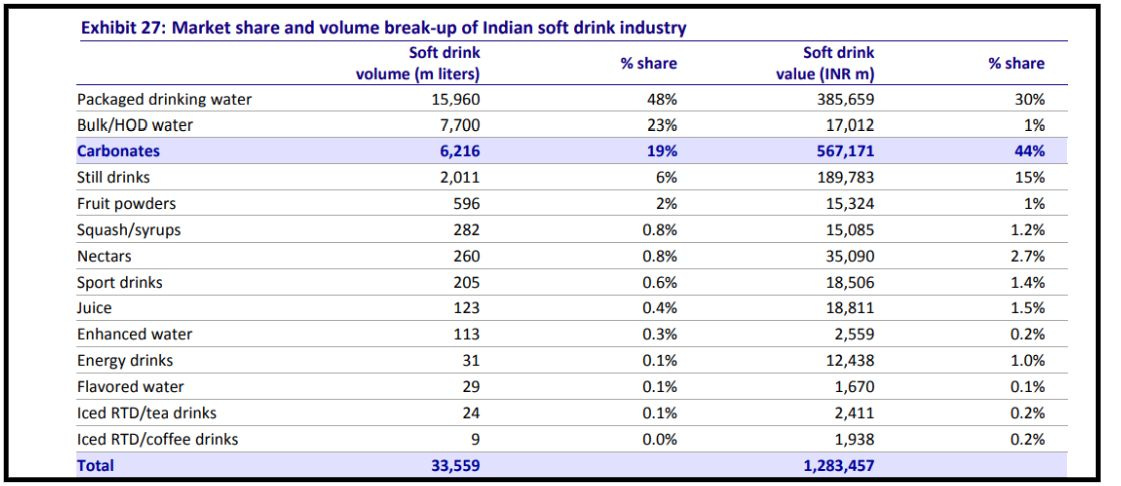

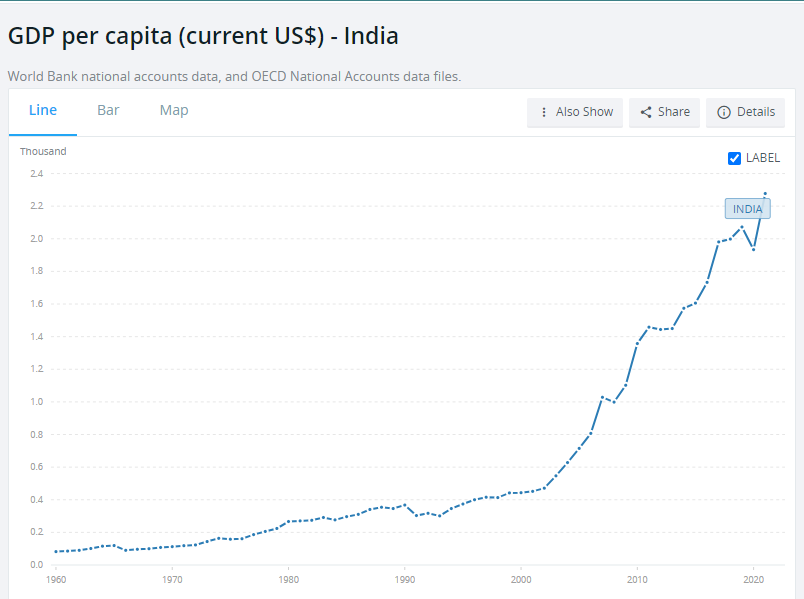

The global non-alcoholic beverage market was worth USD 1,180 billion in 2020 and is projected to reach USD 2,175 billion by 2026, with a CAGR of 7.3%. Over 60% of the global market was accounted by carbonated soft drinks (CSDs), ready-to-drink (RTD) tea/coffee, energy drinks and sports drinks. Consumption of soft drinks in India is much lower than that in developed nations (at 44 bottles per capita in India v/s 1,496 bottles in US) due to lower per capita income/low household electrification. However, this is expected to change with increasing disposable income and growing electrification in rural part of the country on the back of several government initiatives.

While the market share of CSDs is the highest, the top-most socio-economic class is moving away from the consumption of CSDs to NCBs due to increasing health awareness. As per the Avendus report health F&B is growing at 20% CAGR (~1.5x of the total packaged F&B market growth).

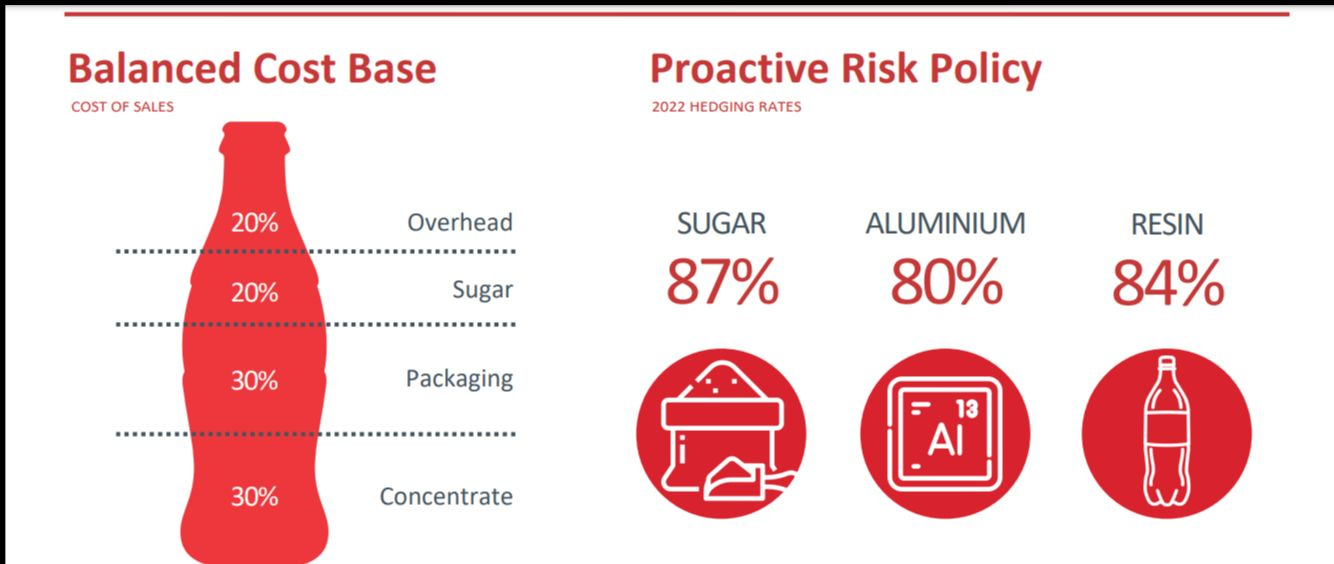

Raw material

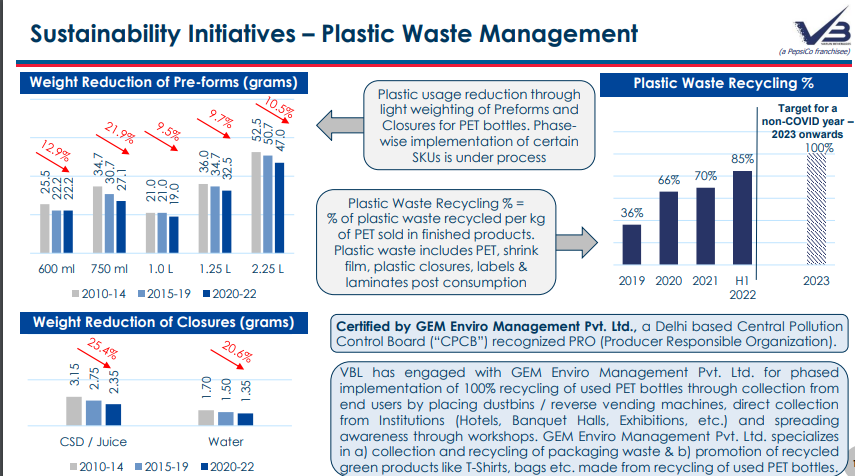

Some common raw materials which are being used for manufacturing of NCBs, CSDs are sugar, PET bottle, water, caffeine, food pulp and concentrate. The manufacturing cost is not a big issue for bottling company as reflected in their gross margins too. Across the globe bottlers are taking up a step to recycle PET bottles and backward integration for corrugated boxes, shrink wrap sheets, plastic cap closures, and plastic shells. Which helps them to reduce raw material cost, In India you can get PET bottle scrap at a minimum rate of Rs 20-30 per kilogram.

OLIGOPOLY/ IMPERFECT COMPETITION

Beverage industry is classic example of non-collusive oligopoly (having two to ten player selling differentiated products). It refers to the situation where the firms compete with each other and follow their own price and quantity and output policy independent of its rival firms. Beverage industry is dominated by two players in Indian market Coco-Cola and PepsiCo. There always exists an excess capacity under oligopoly market because of huge TAM.

Common features of oligopoly industry

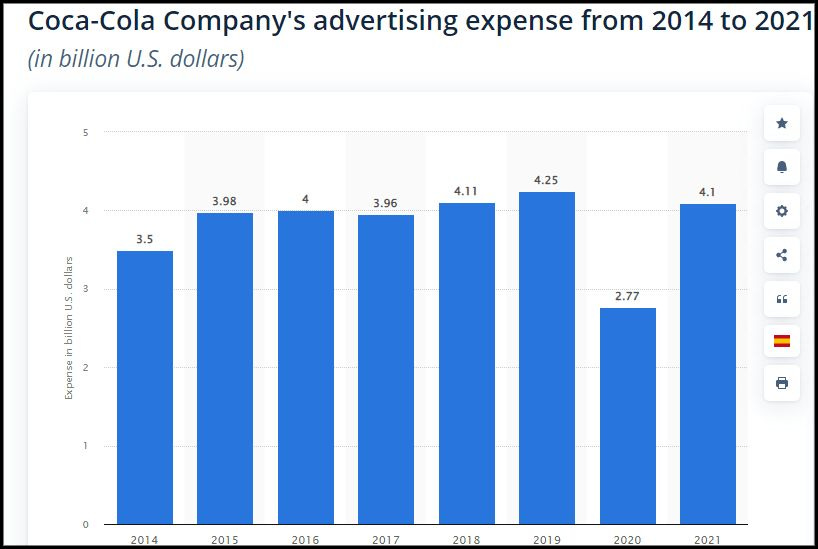

- Avoid price war: Firm in oligopoly avoid price wars and focus on non-price front by spending more on adds and promotion.

Example- Coco-Cola and PepsiCo always avoid price wars and spend more on promotion and adds. Even you can see price of soft drinks hardly increase by 20% in last 5 years, while add spend of Coco-Cola and PepsiCo increased by average 30%-40%. Although add spend of Coco-Cola is inline in last 5 years.

- Interdependence: Reaction of other firm must be considered by a firm in oligopoly before taking a decision.

- Peculiar behavior: In oligopoly market when one firm cuts the price remaining firm also follow the price cut but if one firm increases its price, other firms do not follow the price rise. In economics it’s called Kinked Demand Curve.

Tailwinds

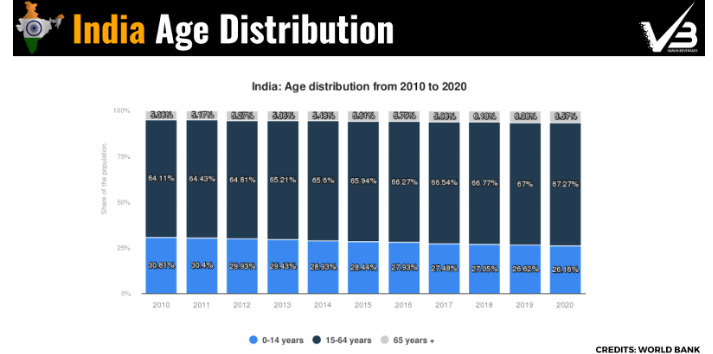

- Demographic Profile: India is a young country with individuals below the age of 30 years accounting for majority of the overall population.

- Rising Affordability and Urbanization: With more than 50% of India’s population falling under the working age category, there has been a rise in disposable income leading to a substantial change in the spending patterns.

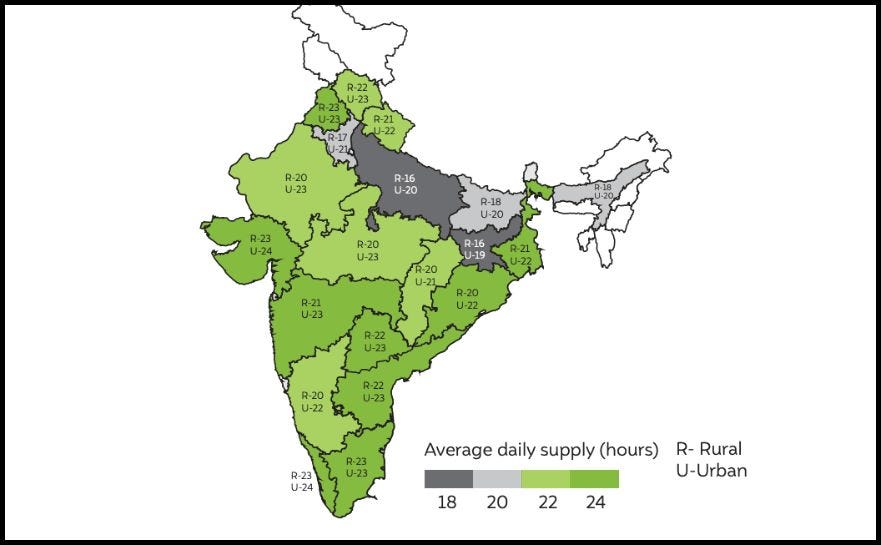

- Electrification: 100% electrification of all villages in India along with improving quality of electricity supply will help enhance penetration of cooling infrastructure in these regions, thereby supporting growth of the industry. India is not a ‘soft drink’ market. It is a ‘cold drink’ market. Refrigeration is a key element in this tropical country, and it needs to be enhanced.

.

DO YOU KNOW-Health-conscious consumers in India going increase from 108 Mn in CY20 to 176 Mn in CY26. .There will be 2x increase in Health F&B spending per capita by health-conscious consumers by CY26.

Varun Beverages-Business overview

COMPANY OVERVIEW

Varun Beverages Ltd is a RJ Corp group company who also owns Devyani International (franchise for Pizza Hut, KFC, and Costa Coffee). It is PepsiCo’s second largest franchisee outside the United States and they have been with PepsiCo for more than three decades since 1991. They operate in 6 countries that are India, Sri Lanka (contributes 1-1.5% of the total volume), Nepal, Morocco, Zambia and Zimbabwe. Within India they have franchise rights in over 27 states and 7 Union Territories. The only ones left are Jammu & Kashmir, Andhra Pradesh, and Ladakh.

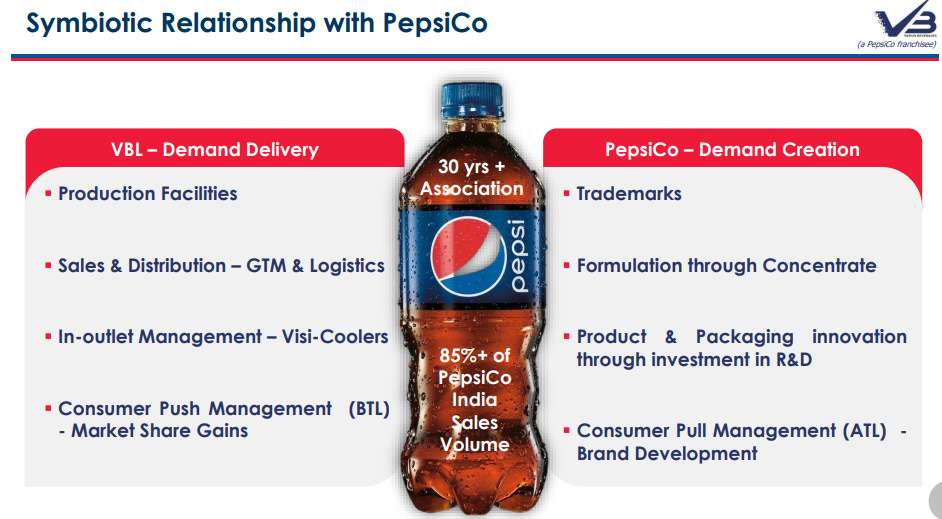

What does a bottler do? They get the concentrate from the brand owner, that is Pepsi in this case, and manufacture the carbonated soft drinks (CSDs) and distribute it themselves. The price of this concentrate is decided by PepsiCo.

PRODUCT AND GEOGRAPHIES

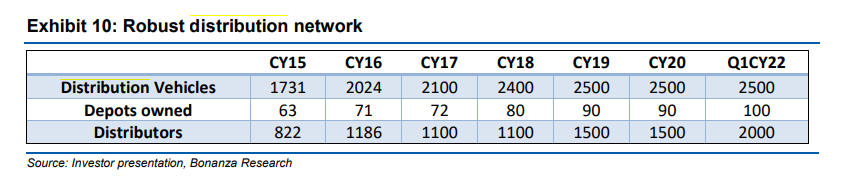

VBL single-handedly accounted for more than 85% of PepsiCo India’s business. Now, it has a presence across India through its 37 state-of-the-art production facilities, along with over 100 depots, 2,500 owned vehicles more than 2,000+ primary distributors, 3 Mn+ outlets and 8,40,000 visi-coolers installed. Its product portfolio includes carbonated soft drinks (CSD), non-carbonated juice-based drinks, energy drinks and packaged bottled water (PDW).

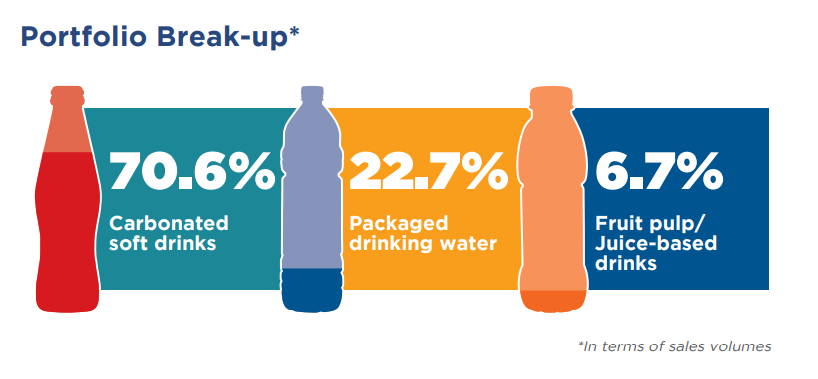

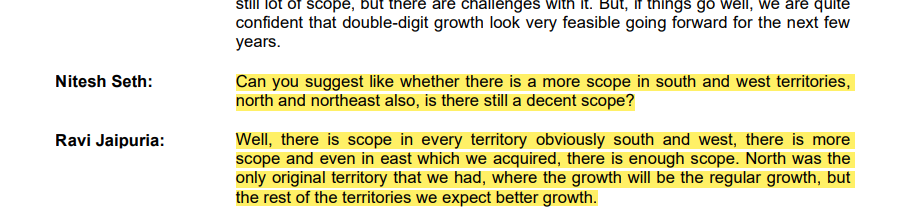

North & East caters to major volume share of approx 67% and 33% respectively in FY21. Significant contribution of International market comes from Morocco, Zambia, and Zimbabwe of approx 21% in FY21. In FY21 CSD constitutes of 70% of revenue, water constitutes of 23% of revenue and NCB constitutes of 27% of revenue.

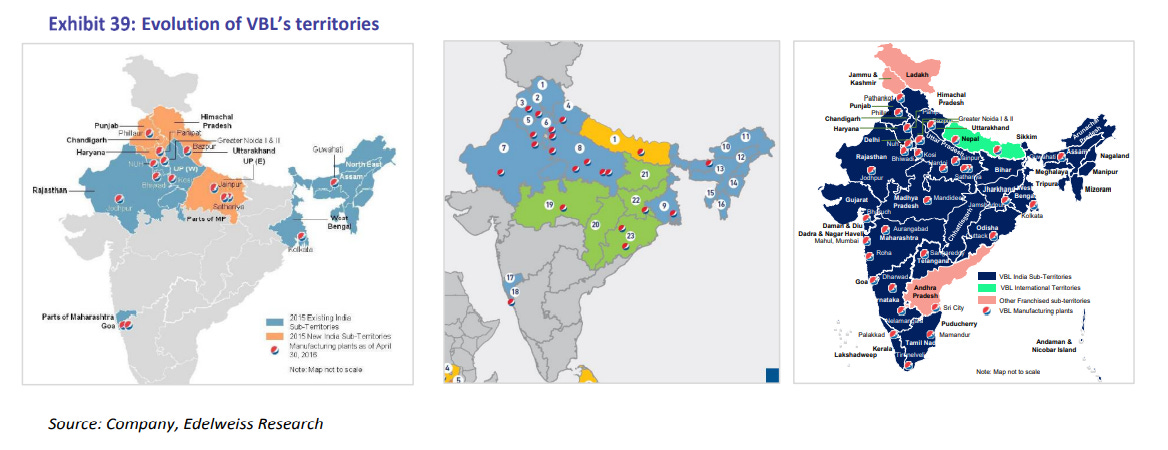

Refer below image to see the evolution of VBL. Till now VBL has spent Rs 36,719 mn for territory acquisition.

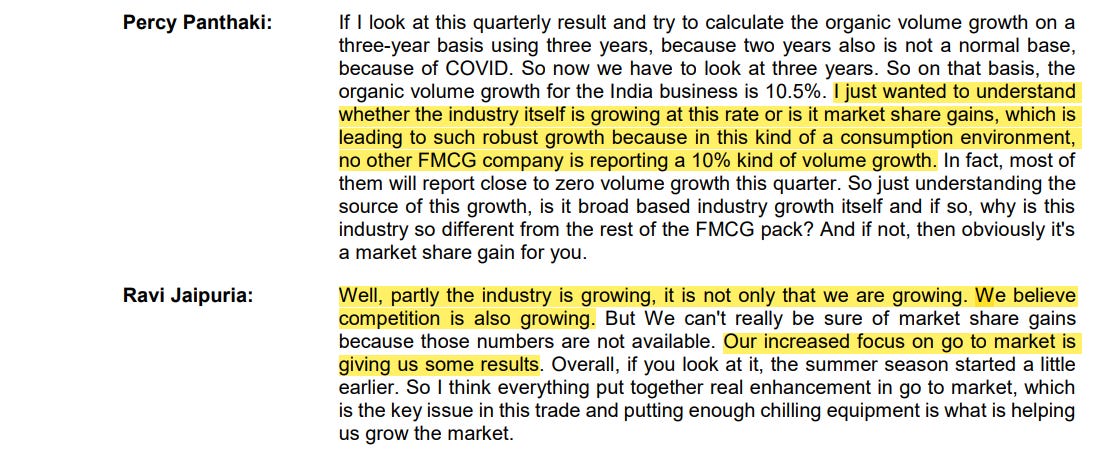

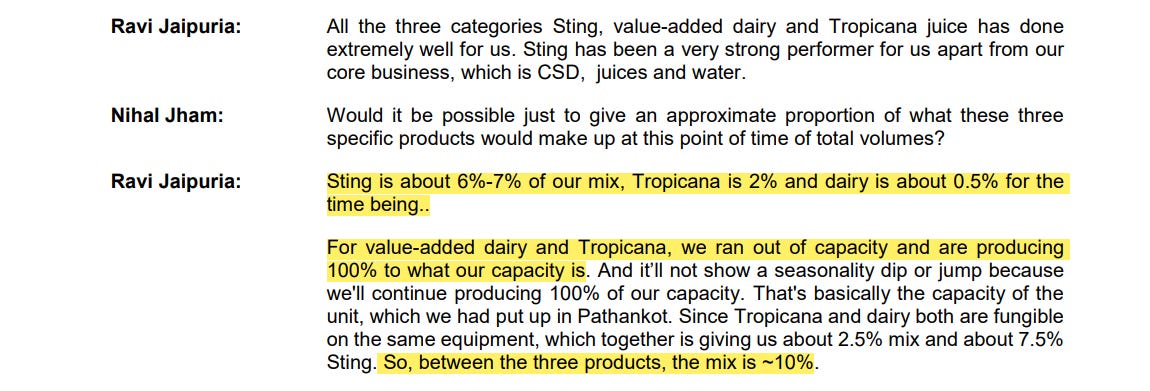

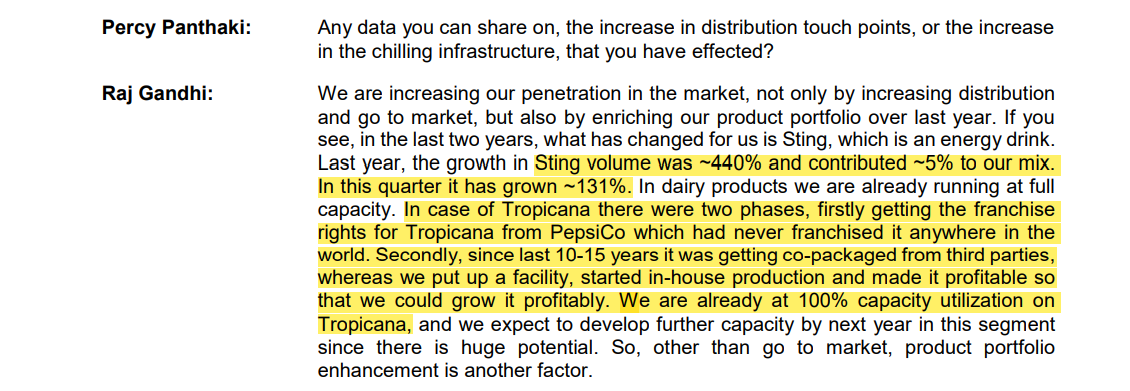

In Q1FY22 Sting volume was ~440% and contributed ~5% to VBL’s mix. In Q1FY22 it has grown ~131%. Sting, Tropicana and Dairy products are contributing about 10% in Q1FY22 and in Q2FY22 sting contribution increased to 10%.

The very recent acquisitions of West and South regions have been completed in H1CY19, resulting in 47% increase in the domestic volumes. While VBL is expected to benefit from the economies of scale in these adjacent territories, the ability to successfully integrate and increase profitability will be a key factor.

VBL’s international presence offers huge potential to grow and reduce geographical revenue concentration. Several inorganic international expansions by the company over CY12-21 resulted in the share of the Water segment rising to 23% from 9%. VBL has added one line in Zimbabwe which will be operational this season by the end of August’22.

STING VS RED BULL

Both Sting and Red bull is energy drink but one significant difference is price while Red bull price is 125 Sting comes at a price of 20. We know Indians are price savy if they have 125 rupees in hand they will buy 6 sting instead of 1 red bull.

But you will ask Sting is cheaper because it may have cheaper quality resources not exactly! Both have same quantity 250ml, same sugar, same caffeine even Sting has more caffeine then Red bull but one thing which is missing in Sting is taurine. As human being grow older our body & brain starts acting slow so taurine helps it to boosts physical performance fight against aging brain and provides many more benefits. Instead of taurine Sting has sodium which is less costly comparing to taurine.

Sting is clearly gaining market share from red bull. I have seen many young kids, adults they are opting sting instead of cold drink and red bull so, Sting is not gaining market share from red bull but also from Coke too as both comes in same price range. The difference between peak google search of Sting and Red bull had reduced drastically in last 2 years.

THREAT FOR STING

Recently a 13 year boy died due to consuming 4 bottle of sting in a day. Although in bottle it has been clearly mentioned that don’t consume more than 2 bottle in a day. Any more case like this is a real risk for VBL as sting is a game changing product in Indian beverage industry so, far there is no mention of age limit for consuming sting.

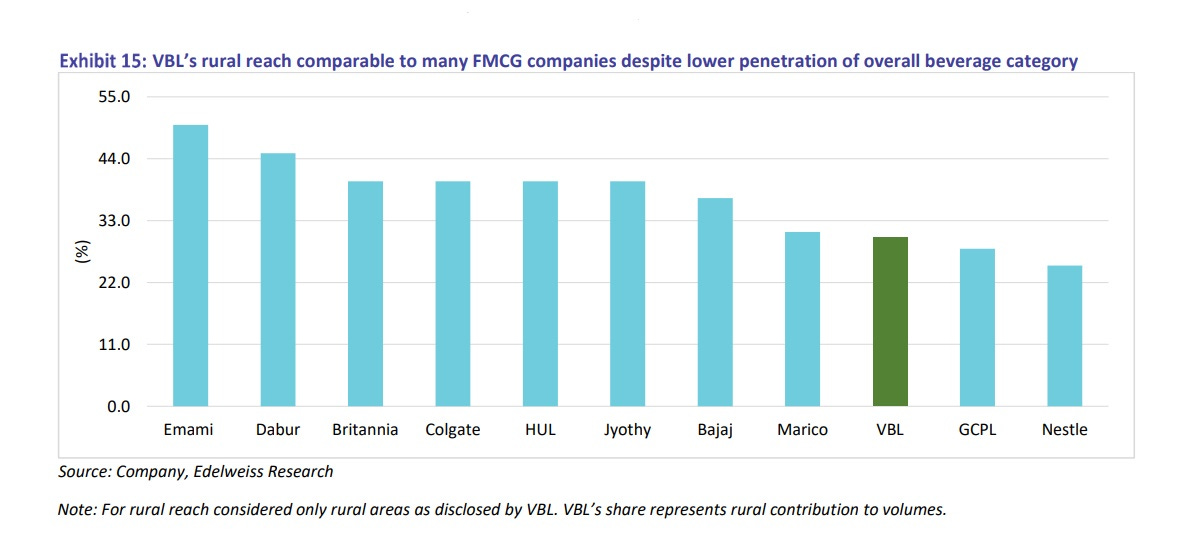

DISTRIBUTION

As a starting point, ~60% of VBL’s outlets are still without VBL’s visi - coolers. This is due to either infrastructure reasons like non-availability of regular electricity supply or stocking of competitor visi-coolers. However, for outlets which don’t have any visi -coolers, given that the cost of the machine is borne by VBL, the issue mainly boils down to infrastructure issues, which are improving driven by rising electrification in the country.

DO YOU KNOW: Shop owner gets the Visi - coolers from Pepsi by deposting nominal amount of cheque Rs10,000 as a security. Shop owner has a condition from PepsiCo and Coco-Cola to keep their products only in their provided visi-coolers or incase of other brand products they need to keep it in last. Pepsi has more brand than Coco-Cola so shop owner always prefer Pepsi visi-coolers an example of win-win relationship.

.

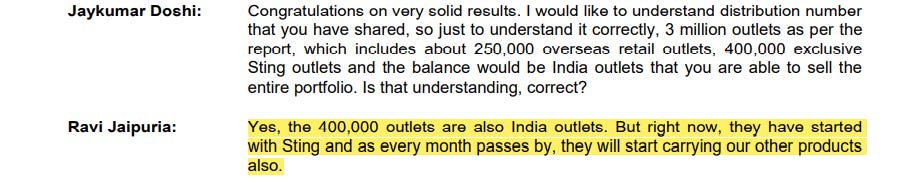

The company increased its distribution network to 3.0 million plus outlets after two years of Covid related disruptions. The 3.0 million outlets include 0.4 million ‘Sting’ only outlets, 0.25 million international outlets. The company would be increasing its distribution footprints by 8-10% every year. In terms of distribution channels, the soft drinks market is divided into off-trade and on-trade. Off-trade sales take place at retail outlets such as grocery stores, hypermarkets, supermarkets, etc. On the other hand, on-trade sales are those which take place at food service outlets, restaurants, bars, clubs, etc. A major part of the sales (95%) is coming from off-trade sales for VBL.

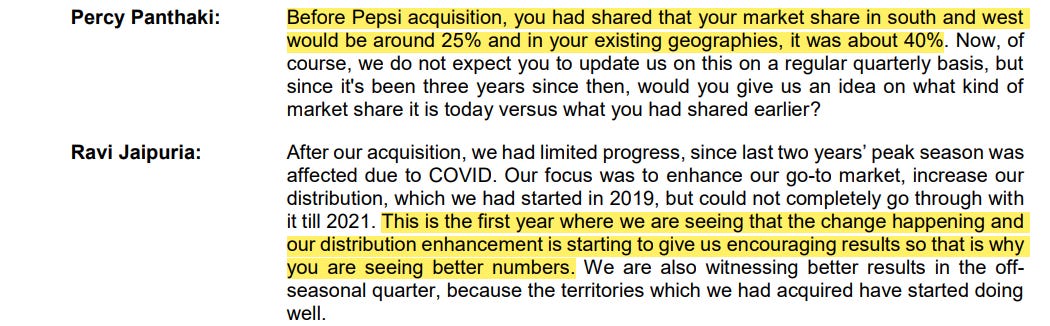

Increasing the distribution network along with newly acquired territories should drive volume growth for VBL in the long run. Also, since acquisition of south & west in May 2019, VBL has still not had the opportunity to drive sales as it has missed out on the peak season due to Covid.

In CY15 VBL has 1731 distribution vehicle fast forward in Q1CY22 VBL has 2500 distribution vehicle. In CY15 VBL has 822 distributors which increases to 2000 in Q2CY22.

VBL has installed 8.40 Lakh+ Visi - Coolers (which they plan to keep adding 40,000 every year) which used to be around 4,50,000+ in 2016. They intend to add 80,000 retail outlets every year. As a smart investor you can keep an eye on this numbers every year, Visi-cooler is a proxy for VBL volume growth.

AGREEMENT WITH PEPSICO INDIA

VBL’s franchise agreement with PepsiCo extended till April 2039, the first time ever for 20 years. Earlier, it used to have contract only for a 10 year period, this makes VBL the only franchisee to have such long term contract.

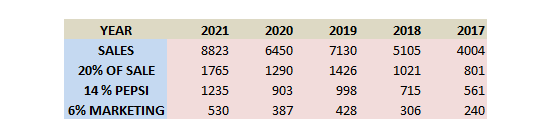

As per the arrangement with PepsiCo, VBL has to set aside 20% of net revenues, out of which, 14% is paid to PepsiCo (8% as concentrate cost that VBL purchases from Pepsi and 6% for the payment towards ‘above the line’ (ATL) advertising spends). The remaining 6% is spent by VBL on below-the-line (BTL) marketing. I have done a rough calculation of last 5 years.

Key risk is PepsiCo india can anytime increase the price of concentrate cost which will impact the gross profit of VBL. In FY21 concentrate cost for VBL is Rs705 crore comparing to Rs516 crore in FY20.

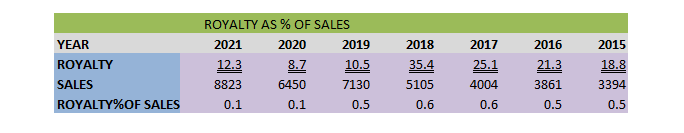

For products, which do not involve any concentrates, VBL pays royalty of 1.3% for “Aquafina” and 1% for “Evervest Soda”. As such royalty is no big issue its hardly 0.1-0.5% of sales.

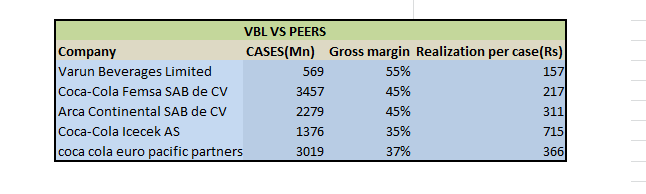

PEER COMPARISON

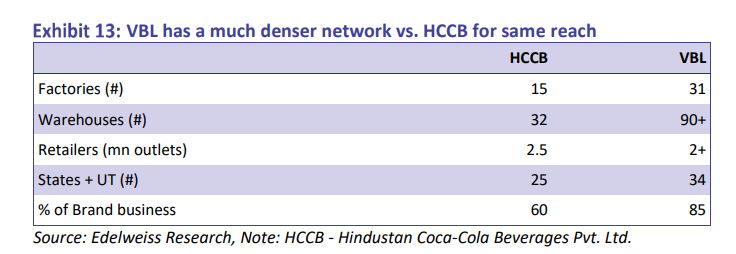

In India there is as such no listed player in bottling business but in terms of market share Coco-Cola has more market share than PepsiCo India. While PepsiCo’s market share as of CY19 was ~35% (consistent so far), Coca-Cola’s market share has dropped to ~56% in CY19 from ~61% in CY12. But one thing to keep in mind that although Pepsico has 35% market share. Market share of VBL in PepsiCo's volume in India has increased from 45% in CY16 to 85% in CY21, while HCCB has only 60% business of Coco-Cola.

In International space VBL has highest gross margin and large TAM to serve but lower per capita consumption with lower realization provides huge runway for growth. Increase in disposable income, electrification, affordability serve as a pin point for soft drink market in India. VBL has sold 569Mn units in FY21 whereas as per Coco-Cola AR21 HCCB has sold 4.3Bn units in India. Source- (Coco-Cola AR2021)

India’s per capita consumption of soft drinks is a long-term volume driver. India’s per capita consumption has posted 16% CAGR over the past decade and despite this, it is much below global average and not even comparable to beverage-heavy markets like the US. While India’s consumption patterns are partially different, there’s still significant room for growth even adjusted for the same. In fact, India’s consumption is lower than many African and Asian countries with lower per capita incomes.

SUSTAINABLE DEVELOPMENT STEPS

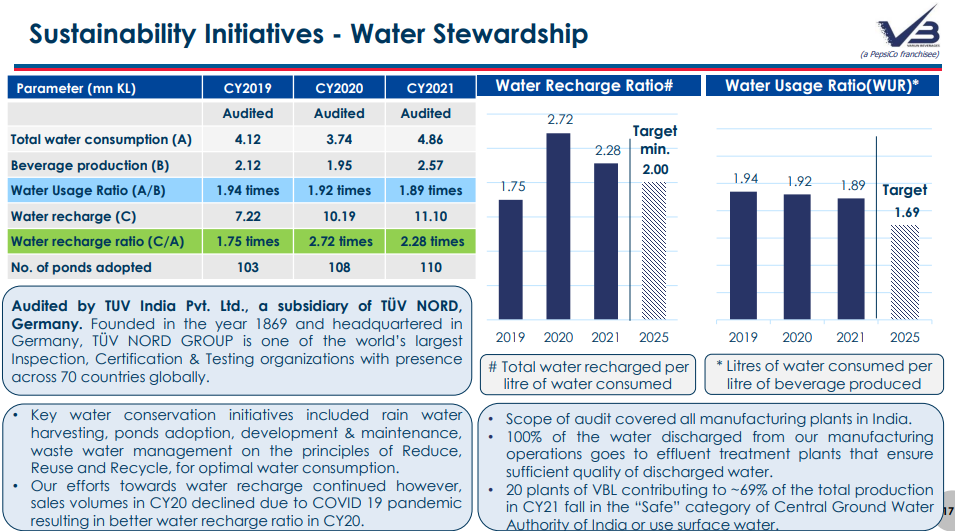

Water is main raw material for VBL given that some parts of India has water shortages. Any misuse of water by VBL will put them in difficulty. In May 2022 SC stays NGT order imposing penalty of over Rs 15 crore on Coca-Cola's bottling unit nd Rs 9.71 crore on Varun Beverages Ltd's Greater Noida unit on the issue of extraction of groundwater in an indiscreet and arbitrary manner, even in areas where the availability of groundwater is an extreme scarcity.

Varun Beverages has got into an agreement with GEM Environment Management Private Limited for recycling of their PET bottles via placing dustbins and vending machines. They specialize in collection and recycling of packaging waste. During H12022, 85% of the PET resin consumed by Varun Beverages was recycled they have target of 100% by 2023.

ENTERING INTO OTHER SEGMENTS: GROWTH TRIGGER

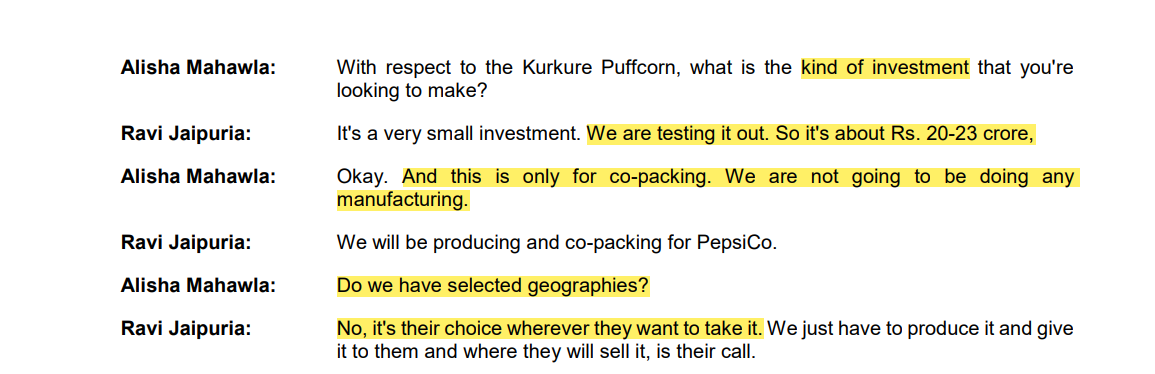

KURKURE PUFFCORN

In Q1CY22, VBL entered into an agreement to manufacture “Kurkure Puffcorn” for PepsiCo, it will start the production from Q3CY22 with an investment of around ₹ 22-23 Cr. This is their first extension into a non-beverage category.

This move could be a step towards something big over time as VBL is known to enjoy a strong relationship with PepsiCo. Addition of all the big food brands of PepsiCo will be a boost to the overall volumes and reduce seasonality of the business as well.

Kurkure, Lays, Cheetos and Uncle chipps are owned by PepsiCo.

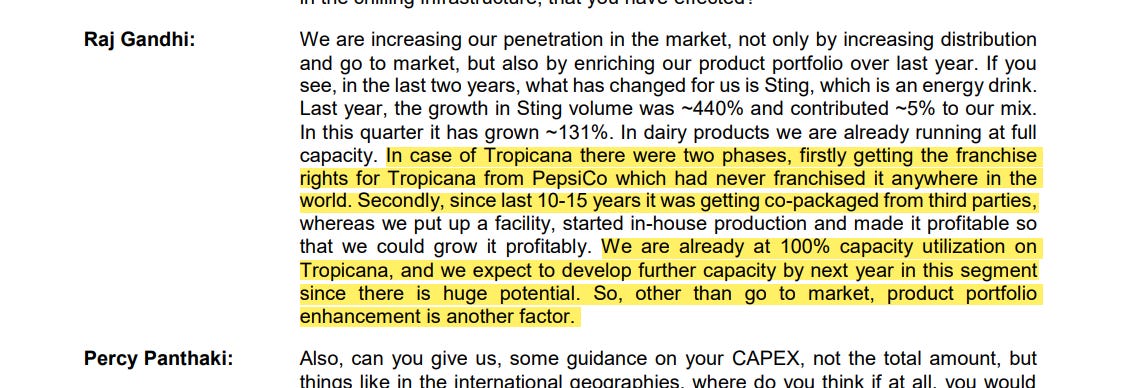

TROPICANA

VBL is first company to get right for tropicana earlier it was done by third parties. Moreover tropicana is value added product and having only 2% mix in revenue it has enough room to capture more share of revenue which will help in margin expansion as happened in Q2FY22. Moreover in Q2FY22 in certain categories like CSD PET, Tropicana, Value added drinks capacity utilisation reached 100% juice contribution in Q2FY22 reached 9%.

MG has decided to further expand capacity in tropicana segment by next year.

THREAT FOR TROPICANA

Recently Maaza becomes Coca-Cola’s fastest growing brand in India. In FY21, Maaza had reported total sales of Rs 2,826 crore, higher than the sales of Coke.

You can compare ad of both tropicana and maaza.

VBL tropicana is competing with Coco-Cola maaza in same segment to increase its market share VBL or Pepsico India needs to bring some unique add which helps customers to recall brand easily. In FMCG brand recall is everything both company has done good job in advertisement for their products.

NO NEW LAUNCHES

Management has no plan to bring more products in market as they are already busy with Mountain Dew Ice, which is a completely new category: it’s a juice-based lemon drink, Tropicana, Sting, and Diary drinks.

It shows management quality to observe trend in market and no hurry to launch new products just for sake.

CAPEX AND DEBT REDUCTION

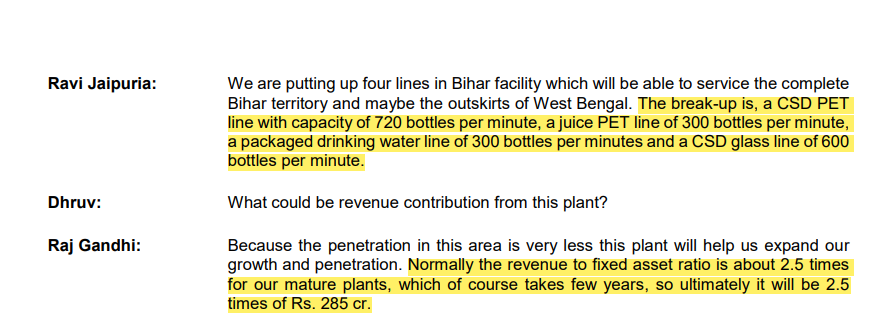

- During H1CY22, the net capex amounted to INR6.7b on account of new greenfield production facilities in Bihar & Jammu and brownfield expansion at Sandila facility.

- Further, VBL in process of setting up two large greenfield plant in MP & Rajasthan. Also, it is in process of expanding brownfield plant in Bihar.

- For CY23, VBL will add ~30% more capacity with capex amounting to INR12b resulting into additional revenue of over ~INR26b going ahead.

- VBL is doubling its capacity in dairy segment by end of CY23 which will add up to the revenue from CY24.

- VBL has added one line in Zimbabwe which will be operational this season by the end of August’22.

Net debt dipped by 950 crore to 2055.5 crore in last six months which is inline with management guidance given in Q1FY22. Net working capital reduced from 24 days in June 2021 to 17 days in June 2022. On further debt reduction management said that if they stop expansion they can be debt free but if opportunity is coming then there is no sign of worry on debt part as long as ROIC/ROCE > Cost of capital.

.

VBL has also written off one machinery RGB producing lines amounting to INR318m during this quarter but the crux is that Coco-Cola president sanket ray in one interview has said that their Focus is on returnable glass bottles and smaller PET packs is paying off in tackling inflationary pressure. So. it may hit VBL in short-mid term if inflation remains here it will tilt market share towards HCCB.

Snippet from Coco-Cola India president interview:

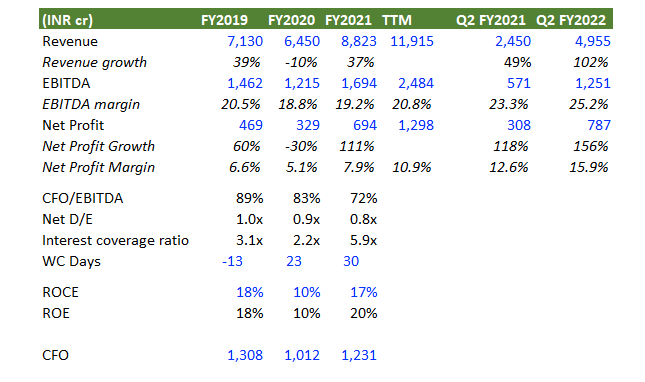

FINANCIALS

- CFO of VBL has grown 10X in last 10 years. It’s only in 2020 where a slight drop was seen due to increase in trade receivables.

- Working capital has increased in last 3 years due to increase in inventories. Net WC days is reduced to ~17 days as on 2QCY22 from 24 days as on 2QCY21, as most of the raw material inventory stocked for the season has been utilized and the business has returned back to normalcy.

- CFO/EBITDA conversion has seen a slight drop in last 3 years but for B2C business as far as its above 70% there is no need to worry.

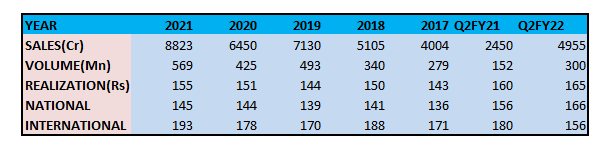

- While the topline has grown at CAGR of 19.3% EBITDA has grown at CAGR of 24% in last 9 years clear cut case of operating leverage and economies of scale if you don’t know these two term kindly check my last blog.

- From here net profit margin will show some improvement due to saving of interest cost and topline growth in next 3-5 years.

- The reinvestment rate(Capex/CFO) of VBL has remain more than 40% in last 9 years while in the year of large capex its shoots up to more than 100% higher the reinvestment rate less money required. Moreover higher the reinvestment rate with higher ROIC, higher chance of growth and PE re-rating.

ACCELERATOR PITCH

- Increase in per capita income with rural electrification, affordability and higher proportion of will help VBL in long run. CSD is a plus point for VBL which distributes juice in ~60- 70% of the total outlets. Currently juice has only 9% share.

- In coming 3-4 years the size of TAM is huge for CY23, VBL will add ~30% more capacity with capex amounting to INR12b resulting into additional revenue of over ~INR26b going ahead. VBL is doubling its capacity in dairy segment by end of CY23 which will add up to the revenue from CY24. Further, VBL in process of setting up two large greenfield plant in MP & Rajasthan. Also, it is in process of expanding brownfield plant in Bihar.

AS per MG guidance of Q1FY22 Bihar plant on mature stage will do approx 710 crore. Also, it is in process of expanding brownfield plant in Bihar due to 90% capacity utilization in Q2FY22

.

- Per Capita consumption of India is only 24 bottles I will not compare it with country like US, Germany but even if the per capita consumption gets double from here it will benefit both VBL and HCCB.

- If VBL gets successful in manufacturing of Kurkure which is starting from Oct/Nov’22 then there may be a chance PepsiCo India will provides more business of puffcorn to VBL.

- Onset of earlier summer monsoon in India will also derives consumption of beverages. This year north India, Bihar, Jharkhand, West Bengal and Odisha, had experienced some extreme heatwave and moreover state such as MP, Orissa, Bihar, Jharkhand and Chhattisgarh have shown robust growth during the quarter.

VALUATION

There is no doubt that VBL enjoys premium multiple then its global average and inline with FMCG Food processing industry multiple.

There is the element of operating leverage with economies of scale which plays with the seasonality of demand. According to the calendar year Q1 & Q2 being the higher one and Q3 and Q4 on the lower side. Q2 is the peak of summer and Q4 is the peak of winter.

Guidance:

The management is expecting double-digit volume growth going forward as the juices, energy drink, and dairy products segment are growing very well. It expects to sustain current margin levels, which can improve further if the price of key raw material – PET resins – softens.

By doing a quick reverse DCF analysis for the company we can see that the earnings growth expectation for them on the basis of their CY21 net profits comes at 22%-23% with an assumption of a terminal multiple of 30 times for next 10 years and a discount rate of 12%. In the past the management has been able to grow its net profit higher than 20% except for a few down years like COVID.

KEY THINGS TO WATCH IN FUTURE:

- Performance of south and west territories and the five underpenetrated territories of MP, Orissa, Bihar, Jharkhand, Chhattisgarh. All the territories, core territories of North and Northeast or the territories acquired from PepsiCo in south and west has grown in very secular way, 58%-59% in H12022.

- Movement in realization per case in Q2FY22 domestic realization increased by 6% due to price hike in select SKUs, reduction in discounts/incentives and improvement in mix. Realization per case will improve due to increase in juice mix which is only 9% of sale volume.

- Currently, VBL only do manufacturing of Kurkure the distribution is being done by PepsiCo India. If in future all the supply chain offered by PepsiCo to VBL then there will be huge value unlocking.

- Growth in visi coolers, distribution and retail outlets will act as a proxy for growth in VBL sale volume. In present VBL have 3 million retail outlets while Coco-Cola may still be higher as per VBL management.

KEY RISKS

- Pepsi agreement: VBL’s entire business is solely dependent on its relationship with PepsiCo. Though the franchise agreement was recently extended to 2039, any future changes in the contractual agreement will have major repercussions on VBL’s business dynamics. Apart from that, VBL has to set aside 20% of net revenues, of which, 14% is paid to PepsiCo and the remaining 6% has to be spent by VBL on below-the-line (BTL) marketing. Any major change in this arrangement will have a huge impact on VBLs profitability. However, in case of termination PepsiCo is required to provide a written notice of at least one year prior to expiration of such agreements. Also, there is a call option in place for PepsiCo to purchase the assets of VBL at an agreed price plus or minus 30% depending on the reason of termination.

- Seasonality factor- The April-June quarter is the peak season for VBL, where around 40% of the sales are recorded. This is due to the seasonal nature of its business as consumption takes place largely in May (summer season). We can expect the seasonality to reduce, as they expand more into international territories and enter into the food business going forward.

- Awareness towards healthy beverages - Increasing awareness with respect to high sugar content in CSDs is gradually leading to a reduction in its consumption, and thus, affecting volumes. Failure of not being able to expand its NCB business will cause VBL to take a back step among its competitors. Although VBL is switching towards NCB by launching new products such as tropicana, dairy products but in juice segment competition can come from domestic player like Dabur (real juice), Coco-Cola (Maaza) and Parle Agro (frooti).

- Susceptibility to changes in regulations- The domestic beverage industry remains susceptible to regulatory changes regarding the content in soft drinks, increasing environmental concerns over groundwater depletion, and discharge of effluents by bottling plants in India. Evolving issues related to the disposal of plastic may also impact the industry.

- Consumption pattern change or overall slowdown impact on growth-A slowdown in growth driven by significant changes in consumer preferences, leading to permanent loss of volumes. Also, overall slowdown in the industry either due to higher taxes and weak macro like COVID also remains a risk as the category is still relatively discretionary.

Thank You for reading whole blog :)

Disclosure: Nothing in this blog should be construed as investment advice. Please consult your financial advisor.

VBL has invested 26.34% in equity share capital of SPV Huoban Energy 7. SPV engaged to supply solar power in Maharashtra on 09 May 23. Scroll down the page which loads with the link below

https://www.zaubacorp.com/company/HUOBAN-ENERGY-7-PRIVATE-LIMITED/U40105TG2021PTC157634. There are 1156 companies with the same address....something fishy here?